The Pros and Cons of Holding a Day Trading Position Overnight

Day trading can be an exhilarating and fast-paced venture, but one question often arises: whether it's wise to hold a day trading position overnight. In this article, we'll discuss the pros and cons of overnight trading to help you decide on your trading strategy.

Understanding Overnight Trading

As the name suggests, overnight trading is the practice of holding a trading position beyond the regular trading hours, spanning from the close of the market on one day to the opening of the market on the next day. While day trading involves opening and closing positions within the same day, overnight trading extends the timeframe for holding positions, exposing traders to unique opportunities and challenges.

For day traders, the decision to hold a position overnight can be crucial, as it introduces additional risks and considerations that may not be present during regular trading hours. Unlike day trading, where positions are typically closed out before the market closes, overnight trading requires traders to maintain their positions overnight, exposing them to potential price fluctuations and market movements outside regular trading hours.

The Pros of Overnight Trading

Holding a position overnight offers several potential advantages for traders, making it a strategy worth considering despite its inherent risks. Here are some of the key benefits of overnight trading:

Extended Profit Opportunities

One of the primary benefits of holding a position overnight is capturing potential gains that may occur outside of regular trading hours. News events, earnings reports, or other market-moving developments can impact prices overnight, allowing traders to capitalize on price movements that may not be fully reflected during the day.

By holding positions overnight, traders can profit from significant price swings while the market is closed.

Diversification of Trading Strategies

Incorporating overnight trading into your strategy can diversify your approach and potentially enhance your overall returns. By taking advantage of overnight opportunities, traders can broaden their trading horizons and adapt to different market conditions, complementing their day trading activities.

Diversification is a key principle of successful trading, and incorporating overnight trading can help traders spread their risk across different timeframes and market environments.

Avoiding Day Trading Restrictions

Some brokerage accounts impose restrictions on day trading, such as minimum balance requirements or limits on the number of daily trades. Overnight trading allows traders to bypass these restrictions and continue trading outside of regular hours, providing more flexibility and freedom in their trading activities.

By holding positions overnight, traders can avoid the constraints imposed by day trading rules and take advantage of opportunities that may arise outside of regular trading hours.

The Cons of Overnight Trading

Despite the potential benefits, overnight trading comes with challenges and risks that traders must consider carefully. Here are some of the key drawbacks of holding positions overnight:

Increased Risk

One of the primary drawbacks of overnight trading is its heightened risk level. Overnight gaps, where prices open significantly higher or lower than the previous close, can result in substantial losses for traders caught on the wrong side of the market.

News events, economic data releases, or other market-moving developments outside regular trading hours often cause these gaps. Traders must be prepared to manage the increased risk associated with overnight trading and implement effective risk management strategies to protect their capital.

Lack of Liquidity

Another challenge of overnight trading is the reduced liquidity in the market outside of regular trading hours. Trading volume tends to be lower during overnight sessions, which can lead to wider bid-ask spreads and increased slippage.

Wider bid-ask spreads make it more expensive for traders to enter and exit positions, while increased slippage can result in trades being executed at prices less favorable than expected. Traders must carefully consider the liquidity conditions during overnight sessions and adjust their trading strategies accordingly to minimize the impact on their trades.

Unforeseen Events

Overnight trading leaves traders vulnerable to unforeseen events that can cause sudden and unpredictable price movements. These events, such as geopolitical developments, economic data releases, or corporate announcements, can significantly impact market sentiment and direction.

Traders must be prepared to react quickly to unexpected events and adjust their trading strategies accordingly. While traders can attempt to mitigate these risks through careful analysis and risk management strategies, unforeseen events can always impact the market overnight.

Risk Management Strategies for Overnight Trading

As overnight trading poses unique risks, traders must employ effective risk management strategies to protect their capital and navigate the challenges of trading outside regular hours. Here are some key strategies to consider:

Put Stop-Loss Orders in Place Stop-loss orders, which automatically close off a trade if it reaches a predetermined price level, can help limit possible losses. In light of volatility and market conditions, traders should carefully assess their risk tolerance and set stop-loss orders appropriately.

Staying Informed

Keeping abreast of relevant news and market developments is essential for overnight traders. Being aware of potential catalysts and events that could impact prices can help traders make informed decisions and react quickly to changing market conditions. Traders can use news alerts, economic calendars, and other resources to stay informed and monitor developments that may affect their positions.

Position Sizing

Proper position sizing is crucial for managing risk in overnight trading. Traders should avoid over-leveraging their positions and ensure that they have sufficient capital to withstand potential losses.

By sizing their positions appropriately and managing their risk exposure, traders can help protect themselves against adverse market movements and preserve their capital.

Conclusion

Holding a day trading position overnight can offer opportunities for extended profit potential and diversification of trading strategies. However, it also comes with increased risks, including overnight gaps, reduced liquidity, and unforeseen events.

Before engaging in overnight trading, it's important for traders to carefully weigh the potential rewards against the risks and implement effective risk management strategies. By staying informed, setting stop-loss orders, and practicing prudent position sizing, traders can navigate the challenges of overnight trading and potentially enhance their overall trading performance.

On this page

Understanding Overnight Trading The Pros of Overnight Trading Extended Profit Opportunities Diversification of Trading Strategies Avoiding Day Trading Restrictions The Cons of Overnight Trading Increased Risk Lack of Liquidity Unforeseen Events Risk Management Strategies for Overnight Trading Staying Informed Position Sizing Conclusion

By Rick Novak : Nov 02, 2024

How do you calculate interest on a loan?

To determine the interest payment, multiply the monthly rate of interest by the amount of outstanding loan balance.

Read More

10738

By John Davis : Oct 25, 2024

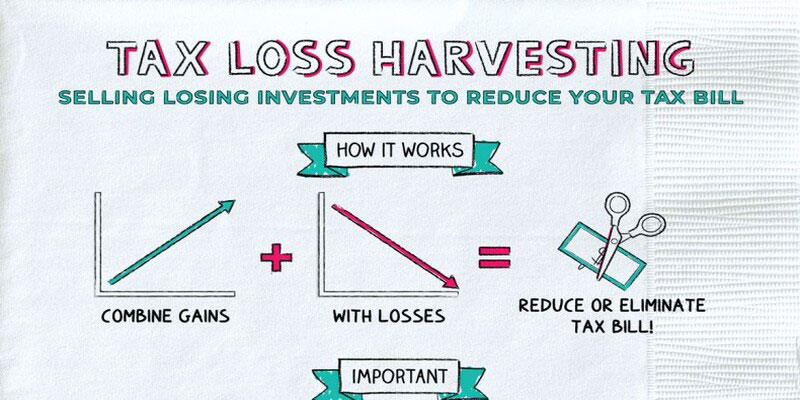

Why You May Profit From Tax-Loss Harvesting

When an investor realizes a loss on an investment, the loss can be used to offset the capital gains tax that was previously paid on a profitable investment. Incorporating this strategy into your investment approach could help you increase your portfolio's returns while decreasing your tax bill. Gaining the most from tax-loss harvesting requires investors to plan ahead regarding the timing and form of their sales, take into account the wash sales restrictions, as well as make use of tax-loss harvesting methods.

Read More

7383

By Kelly Walker : Nov 19, 2024

Is a Personal Loan Right for You? Top Reasons to Consider

Explore why taking out a personal loan could be a smart move for your finances and future. Learn about the benefits and scenarios where a personal loan could be your best option.

Read More

16079

By Rick Novak : Jan 06, 2025

5 Top VA Loan Lenders

Explore the best VA loan lenders to find out about top choices so you can make better decisions for financial assistance.

Read More

18211

By Rick Novak : Nov 29, 2024

7 Proven Strategies for Maintaining A Good Credit Rating

Secure your financial future by keeping a healthy credit score. Read our 7 strategies and start today

Read More

6966

By Rick Novak : Aug 02, 2024

How to Build the Best Lazy Portfolio: A Beginner's Guide

Learn how to create a lazy portfolio with our beginner-friendly guide. Find out about asset allocation, fund selection, and tips for long-term success.

Read More

9265

By Rick Novak : Sep 30, 2024

How Bonds Affect the Stock Market: Everything You Need to Know

This article provides a detailed overview of how bonds affect the stock market and their mutual relationship

Read More

8103

By Kelly Walker : Dec 04, 2024

Understanding the Expenses of Nursing Home Care

Get an estimate of the typical cost for nursing home care now and know about the expenses in senior living facilities.

Read More

10795

By Kelly Walker : Oct 05, 2024

Potential Warnings About Index Funds

Investing in index funds can be a great way to grow your money, but there are also potential risks that should be considered. Learn what you need to know and pay attention to before making an informed decision about your finances.

Read More

12346

By Rick Novak : Aug 14, 2024

The Pros and Cons of Holding a Day Trading Position Overnight

Should you hold a day trading position overnight? Explore the risks and potential rewards of overnight trading in this informative article.

Read More

768

By Kelly Walker : Nov 17, 2024

Walking Away from a Home and Mortgage: A Comprehensive Guide

Thinking about walking away from your home and mortgage? Understand the implications, consequences, and alternatives with our comprehensive guide.

Read More

10458

By Rick Novak : Aug 20, 2024

Debt and Credit Obsolescence and How to Survive It

Removing debt and credit score enhancement requires budgeting, spending only what you earn, and paying with cash or debit. Credit-checked services may also be limited

Read More

106