Is a Personal Loan Right for You? Top Reasons to Consider

Are you in a financial pinch or have a big expense looming? Perhaps you're considering a personal loan but wondering if it's the right move. Well, let's dive into the world of personal loans and explore compelling reasons why taking one out might just be the solution you need.

Reasons To Get a Personal Loan

Here are some of the reasons to get a personal loan. Let's hop on to give them a quick read.

Debt Consolidation

One of the primary reasons individuals opt for personal loans is to consolidate their debt. If you find yourself juggling multiple debts with varying interest rates and due dates, consolidating them into one personal loan can streamline your financial situation.

With a single monthly payment and a potentially lower interest rate, you can better manage your debt and even save money in the long run. By streamlining your payments, you can focus on paying off your debt faster and more efficiently.

Emergency Expenses

Because life is unpredictable, crises might strike at any time. Having quick money on hand can ease worries during trying times, whether it's for an unexpected home expense, auto repair, or medical payment.

Personal loans are a great way to pay for unforeseen expenses without using up all of your cash or turning to high-interest credit cards because they frequently provide quick approval and funding.

Home Renovations

Dreaming of a kitchen remodel or bathroom upgrade? Personal loans can provide the funds needed to turn your home improvement dreams into reality. Unlike home equity loans or lines of credit, which require your home as collateral, personal loans are unsecured, meaning you don't have to put your property at risk.

With fixed interest rates and predictable monthly payments, you can budget effectively for your renovation project and enhance the comfort and value of your home.

Major Purchases

Whether it's a new appliance, furniture set, or electronic gadget, major purchases can strain your budget if you don't have the cash on hand. Instead of resorting to high-interest credit cards or delaying your purchase, consider taking out a personal loan.

With competitive interest rates and flexible repayment terms, personal loans offer an affordable way to finance large expenses while spreading the cost over time. Plus, you won't have to deplete your savings or disrupt your financial goals to make the purchase you desire.

Wedding Expenses

Planning a wedding can be one of the most exciting yet expensive endeavors in life. From venue rentals to catering and attire, the costs can quickly add up. Instead of draining your savings or relying on high-interest credit cards, consider a personal loan to cover wedding expenses.

You may fund your ideal wedding and spread the payments over time with a personal loan, which frees you up to concentrate on making priceless memories rather than worrying about money.

Travel and Vacation

Whether it's a cross-country road trip or an exotic getaway, travel expenses can put a strain on your finances. However, travel experiences often enrich our lives and create lasting memories.

If you're dreaming of exploring new destinations but lack the funds upfront, a personal loan can help make your travel dreams a reality. By financing your trip with a personal loan, you can enjoy the adventure now and repay the loan with manageable monthly installments later.

Medical Expenses

Unexpected medical bills can wreak havoc on your finances, especially if you're uninsured or facing a high deductible. Whether it's a sudden illness, injury, or elective procedure, medical expenses can quickly accumulate. In such situations, a personal loan can provide the necessary funds to cover medical costs and ensure you receive the care you need without delay.

When there are options for flexible repayment, you may focus on your health and well-being instead of worrying about money.

Vehicle Purchase

Need a reliable car for your daily commute or family outings? A personal loan can help you finance the purchase of a new or used vehicle. Unlike auto loans that are tied to specific vehicles, personal loans offer greater flexibility, allowing you to shop around for the best deal and negotiate with confidence.

Whether you're buying from a dealership or a private seller, a personal loan can provide the funds you need to drive away in the vehicle of your choice.

Celebrations and Milestones

Life is full of wonderful occasions to celebrate, like birthdays, anniversaries, graduations, and retirements. But throwing parties and marking anniversaries may be expensive.

If you're planning a milestone celebration but need financial assistance, a personal loan can provide the funds needed to make the event memorable. Whether it's throwing a lavish party or gifting a meaningful experience, a personal loan can help you celebrate life's milestones without breaking the bank.

Investing in Yourself

Sometimes, the best investment you can make is in yourself. Whether it's pursuing higher education, starting a small business, or investing in professional development, personal loans can provide the financial support you need to invest in your future.

By furthering your education or launching a business venture, you can potentially increase your earning potential and achieve long-term financial success. Personal loans offer a flexible and accessible means of funding your aspirations and turning your dreams into reality.

Conclusion

Although getting a personal loan is not a decision that should be made hastily, it can be an effective instrument for reaching your financial objectives and getting past unforeseen obstacles. From consolidating debt to funding home renovations and pursuing personal endeavors, personal loans offer flexibility, convenience, and accessibility.

However, it's essential to assess your financial situation carefully, compare loan offers, and ensure that borrowing aligns with your long-term financial plans. With responsible borrowing and strategic planning, a personal loan could be the catalyst for a brighter financial future.

By Kelly Walker : Aug 19, 2024

The Social Security Trust Fund: What You Should Know

Social trust finance manages surplus contributions to ensure elderly and disabled people get scheduled income funded by payroll taxes.

Read More

218

By John Davis : Oct 25, 2024

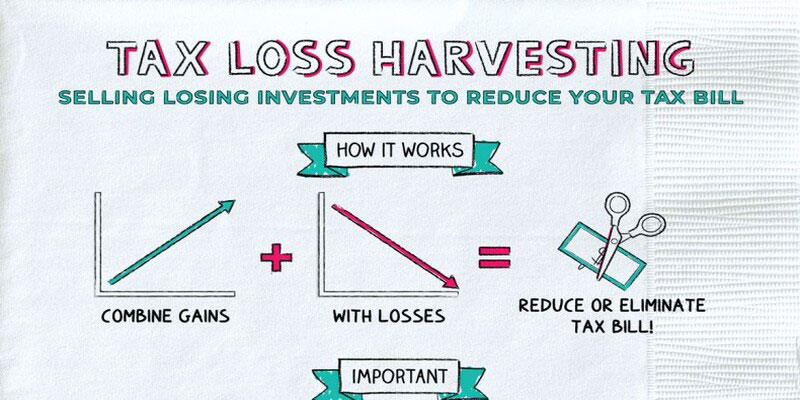

Why You May Profit From Tax-Loss Harvesting

When an investor realizes a loss on an investment, the loss can be used to offset the capital gains tax that was previously paid on a profitable investment. Incorporating this strategy into your investment approach could help you increase your portfolio's returns while decreasing your tax bill. Gaining the most from tax-loss harvesting requires investors to plan ahead regarding the timing and form of their sales, take into account the wash sales restrictions, as well as make use of tax-loss harvesting methods.

Read More

11721

By Rick Novak : Dec 27, 2024

The U.S. Treasury Yield Spread What You Need to Know

Discover what the U.S. Treasury yield spread is, how it impacts the economy and financial markets, and why it's important for investors.

Read More

6019

By John Davis : May 18, 2025

How To Stay On Track With Your Financial Plan Resolves For The New Year

New Year's financial resolutions are more likely to be kept if they involve setting realistic and measurable goals, creating a budget, automating savings, reducing debt, boosting income, reviewing insurance, seeking professional guidance, and keeping motivation levels high. If you follow these steps, you'll be on your way to building the financially stable future you've always imagined.

Read More

3482

By Rick Novak : Dec 05, 2024

Trading with Momentum: An Overview

On paper, momentum investing is less of a conscious strategy and more of a reactive response to market news. The traditional proverb on Wall Street that you should "buy cheap and sell high" runs opposite to the approach of selling underperforming companies and purchasing winning ones. This technique, which may appear enticing at first, is counterproductive

Read More

9060

By Rick Novak : Sep 30, 2024

How Bonds Affect the Stock Market: Everything You Need to Know

This article provides a detailed overview of how bonds affect the stock market and their mutual relationship

Read More

6286

By John Davis : May 18, 2025

What Are The Key Differences Between Exchange-Traded Funds (ETFs) And Index Funds?

Exchange-traded funds (ETFs) and index funds allow investors to purchase a diversified portfolio of securities. While index funds are mutual funds meant to passively track a specific market index, exchange-traded funds (ETFs) are traded like individual stocks. They can be managed either passively or aggressively. ETFs typically have lower entry thresholds than index funds, and ETFs change more frequently.

Read More

8127

By Rick Novak : Dec 29, 2024

Things to Know Before Buying a Short Sale on a House

Check the property's value and the home for damage before buying shop board shorts on sale. Short sales may also require quick action.

Read More

1293

By Rick Novak : Oct 29, 2024

Crossing the Financial Bridge: A Comprehensive Bridge Loan Guide

Explore bridge loans: learn types, how they work, and examples. Discover how they bridge financial gaps effectively.

Read More

17385

By Rick Novak : Aug 20, 2024

Debt and Credit Obsolescence and How to Survive It

Removing debt and credit score enhancement requires budgeting, spending only what you earn, and paying with cash or debit. Credit-checked services may also be limited

Read More

11079

By Kelly Walker : Nov 19, 2024

Is a Personal Loan Right for You? Top Reasons to Consider

Explore why taking out a personal loan could be a smart move for your finances and future. Learn about the benefits and scenarios where a personal loan could be your best option.

Read More

6490

By Kelly Walker : Dec 17, 2024

Price vs. Stock Value: What's the Difference?

The price of the stock is what you actually pay for it. However, value is an intrinsic feature of an asset.

Read More

6782