The Social Security Trust Fund: What You Should Know

The U.S. government manages surplus Social Security contributions in two access trust funds. Workers and employers pay payroll taxes to the trust, and independent contractors pay self-employment taxes to the trust. Pensioners and disabled people get scheduled social trust finance Security income from these accounts. Surplus money is invested in federal debt on interest to generate revenue.

A Historical Overview

On August 14, 1935, President Franklin D. signed Social Security into law, transforming American social trust finance policy. To give pensioners economic security holidays, the device started presenting benefits on January 1, 1940. The first recipient, Vermont former prison secretary Ida M. Fuller, got $22,54, signaling the delivery of a program that could end up a cornerstone of the nation's social safety net.

Since its beginnings, Social Security has changed with demography, economics, and politics. One of the largest government applications internationally, it dispensed millions of dollars by 2023. To meet the demands of an increasingly older populace, eligibility criteria, benefit calculations, and investment mechanisms have been modified over the years.

Moreover, social security holidays provide critical earnings for hundreds of thousands of pensioners, disabled people, and survivors within the U.S. Despite ongoing economic and structural reform disputes, its long history of balancing budgetary restraint and social welfare reinforces its role as a cornerstone of American social policy.

OASI And DI Fund Budgets

U.S. Social Security's Old-Age and Survivors Insurance (OASI) and Disability Insurance (DI) trust budgets manipulate payroll and self-employment tax contributions. OASI specializes in retirement and survivor blessings to protect retirees and their households. DI provides cash assistance to disabled people who cannot work. Despite being called distinct funds, these funds pool surplus payroll and self-employment taxes. These contributions are essential for social trust finance programs to provide benefits to eligible recipients.

Since 1990, companies and employees have contributed 6.2% of employee wages, totaling 12.4%. Self-employed people pay 12.4%, including employer and employee payments. This rate stability supports the long-term financial strategy to satisfy long-term obligations without burdening workers or retirees. The access trust funds' structure assures a continuous income stream for program beneficiaries, fulfilling Social Security's promise of economic security holidays throughout life.

Why Trust Funds Are Running Out?

The Social Security access trust funds went into deficit in 2021 as spending outpaced income. As Baby Boomers get retirement leaving behind lesser payroll taxes contributors per benefits beneficiary, shortages may increase.

Disability claim decreases were expected to fund the DI fund through 2098. The retiree and survivor OASI fund will run out of surplus cash in 2033. For both trust funds, 2035 is expected. The funds' income will cover 83% of planned benefits then. Congress hiked payroll taxes to ensure Social Security's viability.

Again, lowering benefits, borrowing to sustain benefits without boosting receipts, or a combination of those could handle forecasted funding gaps. The SSA Office of the Chief Actuary evaluates the financial impact of social trust finance reform proposals.

Factors on Which Benefits of Social Security Trust Funds Depend

Your Social Security retirement payment depends on your 35 highest-earning years' AIME or average indexed monthly earnings. Retirement amounts vary substantially.

If you retire between 66 and 67, your annual benefits increase by 8% each year you delay. This phase ends when you are 70, but it starts the year after full retirement. Social Security holidays recipients receive their entire main insurance amount at FRA 66. They might get 108% of their PIA by delaying payments until next year. A 132% rise would result from delaying until 70.

The benefit depends on when you start. For people 62 and older, the maximum monthly benefit in 2024 is $2,710, or $32,350 annually. It drops to $4,873 ($58,476 per year) at 70. Moreover, Cost-of-living changes are made annually to keep Social Security payouts aggressive with inflation. In 2023, it turned to 8.7%; in 2024, 3.2%. Workers can estimate their Social Security advantages at distinctive retirement while using the Social Trust Finance Administration's internet calculator.

Low-income workers who have been with Social Security access trust funds since 1972 receive minimal benefits. You need eleven years of work experience to qualify. December 2023's special monthly minimum benefit was $50.90, or $610.80 annually. For people who have worked 30 years, it reaches $1,066.50, or $12,798 per year, and increases with each year of low-income labor.

Retirement Benefits of Social Security Trust Funds

Workers with ten years of Social Security contributions can retire early at 62. Waiting until your full retirement age (FRA) between 66 and 67, depending on your start year, increases monthly bills. Benefits grow if you delay retiring until 70, but not after that.

Spouses can claim benefits depending on their own or their spouses' incomes. A non-married divorcee can obtain access trust benefits based on an ex-spouse's earnings record if the marriage lasted at least ten years. For disabled or student children of retirees, payments can continue until age 18. If you're caring for someone else's child, you must be 16.

Disability Benefits

Anyone who can't work owing to a physical or mental disability predicted to last a year or kill them may qualify for social trust finance disability benefits. Qualification usually requires earnings exams. Also eligible are disabled worker's families.

About 8.39 million Americans received SSDI in April 2024. The average monthly benefit was $1,395.17 ($16,742.04) annually. Disability workers averaged $1,537.57 per month ($18,450.84 yearly). Couples of disabled workers earned $418.84 per month ($5,026.08 yearly), and children $494.47 per month ($5,933.64).

Survivor Benefits

A worker's earnings impact their spouse and children's survivor benefits eligibility. Eligible spouses are 60 or older or 50 and disabled. A survivor's spouse caring for a disabled or underage child may qualify for these benefits. A child must be under 18 or disabled to get assistance for security holdings. In some cases, stepchildren, grandchildren, step-grandchildren, and adoptive children may receive benefits.

Parents 62 or older who relied on a deceased worker for at least half of their income may also qualify for assistance. Once an eligible worker dies, certain spouses and minor children receive a $255 lump payout.

By Rick Novak : Dec 24, 2024

"Top Line vs. Bottom Line: Key Indicators of Financial Performance"

Explore key strategies for analyzing and enhancing your company's financial health through top and bottom line growth and strategic planning.

Read More

10422

By Rick Novak : Nov 02, 2024

How do you calculate interest on a loan?

To determine the interest payment, multiply the monthly rate of interest by the amount of outstanding loan balance.

Read More

7175

By Kelly Walker : Aug 19, 2024

The Social Security Trust Fund: What You Should Know

Social trust finance manages surplus contributions to ensure elderly and disabled people get scheduled income funded by payroll taxes.

Read More

17567

By Rick Novak : Dec 05, 2024

Trading with Momentum: An Overview

On paper, momentum investing is less of a conscious strategy and more of a reactive response to market news. The traditional proverb on Wall Street that you should "buy cheap and sell high" runs opposite to the approach of selling underperforming companies and purchasing winning ones. This technique, which may appear enticing at first, is counterproductive

Read More

10450

By Rick Novak : Aug 01, 2024

Achieving Stock Market Mastery: Strategies for Winning Stocks

Discover how to choose winning stocks over losing ones. Practical tips for successful investing in the stock market.

Read More

17839

By Rick Novak : Nov 03, 2024

Unlocking the Path to Credit Repair

Understand the detailed process to eliminate a charge-off from your credit report and boost your credit score properly.

Read More

5502

By John Davis : May 18, 2025

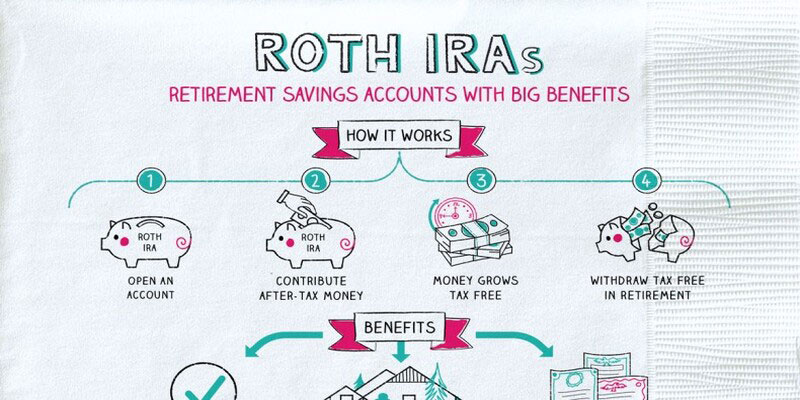

What Should You Know About Roth IRAs?

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances.

Read More

14159

By Rick Novak : Oct 10, 2024

Explaining Trailing Stop Loss in Day Trading

How a trailing stop loss can help you in day trading. Learn how it protects your profits and reduces losses in fast-moving markets.

Read More

7263

By Kelly Walker : Dec 17, 2024

Price vs. Stock Value: What's the Difference?

The price of the stock is what you actually pay for it. However, value is an intrinsic feature of an asset.

Read More

11638

By Rick Novak : Sep 30, 2024

How Bonds Affect the Stock Market: Everything You Need to Know

This article provides a detailed overview of how bonds affect the stock market and their mutual relationship

Read More

2298

By Rick Novak : Dec 27, 2024

The U.S. Treasury Yield Spread What You Need to Know

Discover what the U.S. Treasury yield spread is, how it impacts the economy and financial markets, and why it's important for investors.

Read More

4198

By John Davis : May 18, 2025

What Are The Key Differences Between Exchange-Traded Funds (ETFs) And Index Funds?

Exchange-traded funds (ETFs) and index funds allow investors to purchase a diversified portfolio of securities. While index funds are mutual funds meant to passively track a specific market index, exchange-traded funds (ETFs) are traded like individual stocks. They can be managed either passively or aggressively. ETFs typically have lower entry thresholds than index funds, and ETFs change more frequently.

Read More

8319