What Are The Key Differences Between Exchange-Traded Funds (ETFs) And Index Funds?

If you want to diversify your portfolio of securities, consider exchange-traded funds (ETFs) or index funds. Both exchange-traded funds (ETFs) and index funds (which track the performance of an index like the S&P 500) aim to expose investors to various securities. All day, investors can buy and sell ETFs on stock markets like any other stock. Investors can save money by choosing these funds over actively managed mutual and index funds due to their reduced expense ratio. ETFs, provide investors with more options for their investment styles because they can be passively or actively managed.

Index funds are mutual funds whose goal is to replicate the performance of a certain market index. In contrast to ETFs, index funds are not actively traded throughout the day but solely at the end of the trading day. Passively managed index funds aim to do something other than outperform the index's performance but rather replicate it. Exchange-traded funds (ETFs) and index funds (indices) provide investors with diversification, low expenses, and tax efficiency. Trades, costs, minimum investments, taxes, liquidity, adaptability, and tracking errors vary. Investors should carefully assess their investment goals and risk tolerance when deciding between exchange-traded funds (ETFs) and index funds.

What Are ETFs?

Exchange-traded funds, or ETFs, are a type of security that may be bought and sold on the stock market just like a regular stock. Similarly to mutual funds, exchange-traded funds (ETFs) hold a portfolio of stocks, bonds, or commodities. Conversely, ETFs can be exchanged like stocks at any time of day, unlike mutual funds. Compared to mutual funds, ETFs have lower expense ratios, making them more affordable.

It is possible to either "passively" or "actively" manage ETFs. A passive exchange-traded fund (ETF) aims to replicate the performance of a selected index, such as the S&P 500, by purchasing and holding the same securities in the same weightings as the index itself. However, a portfolio manager oversees active ETFs, making trades based on their assessment of market dynamics and other reasons.

How Do Index Funds Work?

Mutual funds known as "index funds" are created to mimic the performance of market indices like the S&P 500 or the Dow Jones Industrial Average. Index funds, like ETFs, have a diverse portfolio of securities meant to match the index they are tracking. Because of its passive management, index funds are meant to track the index's performance rather than attempt to improve upon it. Index funds have lower expense ratios than actively managed mutual funds since they are not addressed.

Major Differences Between Etfs And Index Funds

Trading

Similar to trading individual equities, ETFs can be made and taken at any time during the trading day. Unlike index funds, whose shares can only be bought and sold after the trading day, ETF shares are freely traded throughout the day.

Expense Ratio

All funds have expenses, and the expense ratio measures how much your investment goes towards those costs. ETFs often have lower expense ratios than other types of mutual funds, including index funds. This is because ETFs are passively managed, unlike actively managed funds, which necessitate more human input and study.

Minimum Investment

As a result, investors of all financial means can buy ETFs. Index funds, conversely, are only sometimes easy for casual investors to get into because of their high minimum investments.

Taxes

Investing in exchange-traded funds (ETFs) or index funds (IFs) can help you save on taxes because they are both tax-efficient investment vehicles. Yet, due to their distinct structure, exchange-traded funds (ETFs) may be more tax-efficient than index funds. To avoid paying capital gains tax when buying and selling ETF shares, investors should do it on a regulated exchange. When shareholders of an index fund sell their shares, the fund may have to liquidate part of its holdings, which could result in capital gains taxes.

Liquidity

Compared to index funds, ETFs have greater liquidity because they are more actively traded. This is because ETFs can be bought and sold at any time throughout the trading day, whereas index funds can only be purchased and sold after the trading day.

Flexibility

Flexibility is an advantage of ETFs over index funds. To diversify their portfolios, investors can utilize ETFs to buy stocks, bonds, and commodities. When investing in a certain market or industry, index funds may provide a different level of specialized exposure than ETFs.

Error In Tracking

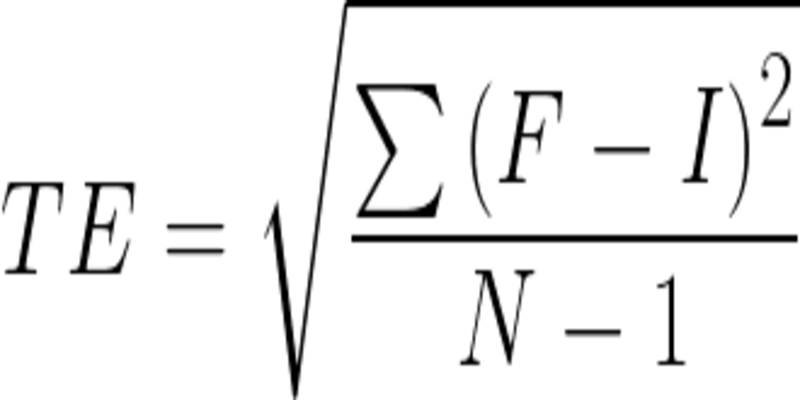

A fund's tracking error is the amount by which its performance deviates from that of an index it is meant to replicate. It measures how far a fund's returns vary from its reference index's.

Conclusion

Exchange-traded funds (ETFs) and index funds (IFs) are widely used by those looking to invest in a diverse portfolio of securities with minimal fees. Trading, expense ratio, minimum investment, taxes, liquidity, flexibility, and tracking inaccuracy are all different, even though they both follow the performance of the same index. Trading ETFs is similar to trading individual equities so investors can access greater flexibility and liquidity. The expense ratios for these funds are often lower than those of index funds. However, exchange-traded funds (ETFs) may incur trading costs and commissions and may be less tax-efficient than index funds.

By Rick Novak : Sep 30, 2024

How Bonds Affect the Stock Market: Everything You Need to Know

This article provides a detailed overview of how bonds affect the stock market and their mutual relationship

Read More

6451

By John Davis : Oct 25, 2024

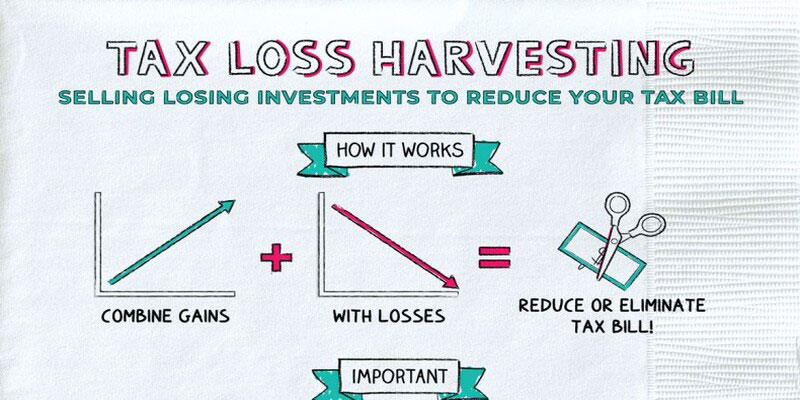

Why You May Profit From Tax-Loss Harvesting

When an investor realizes a loss on an investment, the loss can be used to offset the capital gains tax that was previously paid on a profitable investment. Incorporating this strategy into your investment approach could help you increase your portfolio's returns while decreasing your tax bill. Gaining the most from tax-loss harvesting requires investors to plan ahead regarding the timing and form of their sales, take into account the wash sales restrictions, as well as make use of tax-loss harvesting methods.

Read More

996

By Kelly Walker : Nov 19, 2024

Is a Personal Loan Right for You? Top Reasons to Consider

Explore why taking out a personal loan could be a smart move for your finances and future. Learn about the benefits and scenarios where a personal loan could be your best option.

Read More

5986

By Rick Novak : Aug 14, 2024

The Pros and Cons of Holding a Day Trading Position Overnight

Should you hold a day trading position overnight? Explore the risks and potential rewards of overnight trading in this informative article.

Read More

15039

By Rick Novak : Nov 29, 2024

7 Proven Strategies for Maintaining A Good Credit Rating

Secure your financial future by keeping a healthy credit score. Read our 7 strategies and start today

Read More

5837

By John Davis : May 18, 2025

How To Stay On Track With Your Financial Plan Resolves For The New Year

New Year's financial resolutions are more likely to be kept if they involve setting realistic and measurable goals, creating a budget, automating savings, reducing debt, boosting income, reviewing insurance, seeking professional guidance, and keeping motivation levels high. If you follow these steps, you'll be on your way to building the financially stable future you've always imagined.

Read More

16633

By Rick Novak : Aug 20, 2024

Debt and Credit Obsolescence and How to Survive It

Removing debt and credit score enhancement requires budgeting, spending only what you earn, and paying with cash or debit. Credit-checked services may also be limited

Read More

12219

By Kelly Walker : Sep 11, 2024

An Easy Guide To Postdated Checks: What You Need To Know

Learn about postdated checks: what they are, how they work, legal issues, banking, and alternatives

Read More

4503

By Rick Novak : Oct 26, 2024

How to Tackle Your Student Loans Without Stress: An Ultimate Guide

Do you want to discover effective strategies for managing your student loans? Give this article a read to learn how to plan your repayments, explore refinancing options, and avoid default.

Read More

18557

By Kelly Walker : Nov 22, 2024

International Bank Account Number (IBAN): A Comprehensive Guide

IBAN number is globally used to make banking and transferring money easier and more secure. You can check it easily with your bank or online checkers.

Read More

12923

By Rick Novak : Sep 05, 2024

Unveiling the Mystery: What Exactly Is a Manufactured Home?

Curious about manufactured homes? Learn what they are, how they differ from traditional housing, and why they're becoming a popular choice for many.

Read More

3690

By Kelly Walker : Dec 08, 2024

Using A Tax Break For Your Second Mortgage Payments

The federal government is aware that, for many people in the United States, securing a mortgage will be the most significant long-term financial commitment they will ever make. Because of a provision established by the Internal Revenue Agency, the interest you pay on your mortgage can be deducted from the taxes you owe

Read More

17240