How To Stay On Track With Your Financial Plan Resolves For The New Year

The beginning of a new year represents a time of renewal for many people, especially in terms of their financial goals and resolutions. Because of broken New Year's resolutions, many people need to realize their monetary goals. You will have a far better chance of success if you set specific, manageable goals, create a precise budget and start an automatic savings plan. Eliminating debt, raising income, and evaluating insurance coverage are all steps that can bring you closer to your financial goals.

In addition, it may be helpful to consult a professional if you are dealing with complex financial difficulties or are struggling to achieve your goals. If you need help setting and achieving your financial goals, seeing a professional financial planner or advisor might be a significant first step. In conclusion, you must keep up your motivation to achieve your financial goals. Examining your progress towards your goals regularly, celebrating your successes, and viewing your failures as learning experiences can all help keep you motivated and on track. If you put these suggestions into practice, 2023 will be the year you begin building the financially stable future you've always dreamed of.

Set Clear And Attainable Goals

Establishing specific, achievable goals is the first step in keeping your financial resolutions. Stop saying you want to save more money and start doing something about it by setting a specific savings goal. Verify that your purposes are practical and within reach. It's better to start small and gradually increase the objective than to set an unachievable one and give up when you can't reach it.

Establish A Budget

The first and most crucial step in reaching your financial goals is to create a budget. A budget can help you track your spending, identify saving opportunities, and plan for the future. Regular budget assessments are essential for ensuring financial security and progress towards goals.

Automate Your Savings

Automating your savings plan is the best way to save time and effort. To be more precise, you should set up automatic monthly transfers from your checking to your savings account. Doing this will make you less inclined to spend the money and more likely to stick to your savings strategy.

Lower Your Debt

To become financially self-sufficient, it is essential to eliminate debt. Save away more money each month and focus on the debts with the highest interest rates first. If you have multiple debts, the debt snowball technique recommends starting with the smallest and working on the larger ones.

Boost Income

Increasing your income might be a tremendous aid in achieving your monetary goals. You can establish a small business or find part-time work to supplement your payment. You may seek a salary increase or a new career that pays more.

Assess Your Insurance

Reviewing your policy is one way to find out if you are adequately covered or if you are being overcharged. Review your current insurance policies to see if you can save money or obtain better health, auto, and home insurance coverage.

Consult A Professional

It may be time to talk to a professional if you need assistance achieving your financial objectives or solving complex financial problems. If you need help setting and achieving your financial goals, seeing a professional financial planner or advisor might be a significant first step.

Stay Motivated

Keeping yourself motivated is crucial if you want to achieve your monetary goals. An excellent method to maintain motivation is to look back at your progress so far. Recognize and appreciate even the tiniest successes, and use your setbacks as learning opportunities.

Conclusion

If you want to be successful in maintaining your financial New Year's resolutions, you should do the following: set realistic and attainable goals; make a budget; set up automatic savings; pay off debt; improve income; analyze insurance coverage; acquire expert guidance; stay motivated. If you stick to these rules, you can build a more stable financial future and get closer to realizing your financial goals. Keep your sights on the prize even while you enjoy the fruits of your labour. With the right mindset and methods, you can achieve your financial goals and set yourself up for long-term success.

By Kelly Walker : Aug 05, 2024

Reasons to Avoid Index Funds

Thinking of blindly investing in index funds? Here are some potential risks to consider before you make that decision. Find out the reasons why you should avoid index funds and explore alternatives that may be a better fit for your investment needs!

Read More

9853

By Rick Novak : Dec 29, 2024

Things to Know Before Buying a Short Sale on a House

Check the property's value and the home for damage before buying shop board shorts on sale. Short sales may also require quick action.

Read More

9780

By Kelly Walker : Dec 17, 2024

Price vs. Stock Value: What's the Difference?

The price of the stock is what you actually pay for it. However, value is an intrinsic feature of an asset.

Read More

18335

By Rick Novak : Aug 02, 2024

How to Build the Best Lazy Portfolio: A Beginner's Guide

Learn how to create a lazy portfolio with our beginner-friendly guide. Find out about asset allocation, fund selection, and tips for long-term success.

Read More

11046

By Kelly Walker : Sep 11, 2024

An Easy Guide To Postdated Checks: What You Need To Know

Learn about postdated checks: what they are, how they work, legal issues, banking, and alternatives

Read More

5563

By Kelly Walker : Nov 22, 2024

International Bank Account Number (IBAN): A Comprehensive Guide

IBAN number is globally used to make banking and transferring money easier and more secure. You can check it easily with your bank or online checkers.

Read More

19694

By John Davis : Oct 25, 2024

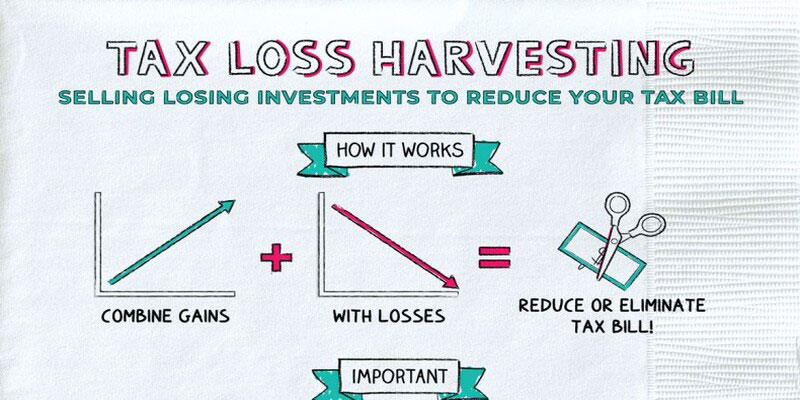

Why You May Profit From Tax-Loss Harvesting

When an investor realizes a loss on an investment, the loss can be used to offset the capital gains tax that was previously paid on a profitable investment. Incorporating this strategy into your investment approach could help you increase your portfolio's returns while decreasing your tax bill. Gaining the most from tax-loss harvesting requires investors to plan ahead regarding the timing and form of their sales, take into account the wash sales restrictions, as well as make use of tax-loss harvesting methods.

Read More

6454

By Kelly Walker : Aug 19, 2024

The Social Security Trust Fund: What You Should Know

Social trust finance manages surplus contributions to ensure elderly and disabled people get scheduled income funded by payroll taxes.

Read More

19469

By John Davis : May 18, 2025

What Are The Key Differences Between Exchange-Traded Funds (ETFs) And Index Funds?

Exchange-traded funds (ETFs) and index funds allow investors to purchase a diversified portfolio of securities. While index funds are mutual funds meant to passively track a specific market index, exchange-traded funds (ETFs) are traded like individual stocks. They can be managed either passively or aggressively. ETFs typically have lower entry thresholds than index funds, and ETFs change more frequently.

Read More

6723

By John Davis : May 18, 2025

How To Stay On Track With Your Financial Plan Resolves For The New Year

New Year's financial resolutions are more likely to be kept if they involve setting realistic and measurable goals, creating a budget, automating savings, reducing debt, boosting income, reviewing insurance, seeking professional guidance, and keeping motivation levels high. If you follow these steps, you'll be on your way to building the financially stable future you've always imagined.

Read More

18332

By Rick Novak : Dec 19, 2024

Planning for Retirement: How Much Money is Enough

How Much Money You Need for Retirement: Tips for Calculating Your Savings Goal and Ensuring Financial Security in Your Golden Years

Read More

9241

By Rick Novak : Aug 31, 2024

What Is an Income Fund?

Get the answers on income funds and learn how they can help diversify your investments. Explore all of the different types available with expert advice.

Read More

3275