How to Build the Best Lazy Portfolio: A Beginner's Guide

Creating a lazy portfolio is a superb strategy for novice investors seeking a straightforward yet effective approach to investment management. By leveraging low-cost, diversified index funds and ETFs, you can build a well-balanced portfolio that demands minimal upkeep. This guide will walk you through the core principles of constructing a lazy portfolio, emphasizing its benefits like reduced fees, broad market exposure, and a hands-off approach.

We'll delve into essential steps such as selecting the appropriate asset allocation, grasping the importance of diversification, and periodically rebalancing your portfolio to align with your financial objectives. Whether you're just starting out or aiming to streamline your investment strategy, this guide will equip you with the tools and knowledge necessary to create the ideal lazy portfolio tailored to your needs.

What is a Lazy Portfolio?

A lazy portfolio is a diversified, low-maintenance investment strategy designed for long-term growth. It typically includes a few low-cost index funds or exchange-traded funds (ETFs), which cover a broad range of asset classes such as stocks, bonds, and sometimes real estate or commodities. By minimizing the need for frequent trading or active management, it reduces costs and the emotional stress associated with market fluctuations. The core philosophy is to set up your portfolio and let it grow with minimal intervention, embodying a "set it and forget it" mindset. This approach leverages the power of compound interest over time and aims to provide steady returns without the need for constant attention or adjustments.

Why Choose a Lazy Portfolio?

- Simplicity: Lazy portfolios are straightforward to understand and manage, making them ideal for beginners.

- Low Costs: By focusing on low-cost index funds and ETFs, you reduce the fees that can erode your returns.

- Diversification: These portfolios usually spread investments across various asset classes, mitigating risk.

- Time Efficiency: With minimal need for frequent adjustments, lazy portfolios free up your time for other activities.

- Proven Performance: Historically, passive investing strategies like those used in lazy portfolios have performed well, often surpassing actively managed funds over the long term.

Steps to Build Your Lazy Portfolio:

1. Determine Your Investment Goals:

Before building your portfolio, it's crucial to define your financial goals. Are you saving for retirement, a down payment on a house, or your child's education? Understanding your objectives will help you decide on your investment horizon and risk tolerance.

2. Assess Your Risk Tolerance:

Your risk tolerance is your ability and willingness to endure market volatility. If you can handle short-term losses for the potential of higher long-term gains, you might opt for a more aggressive portfolio. Conversely, if market fluctuations make you uneasy, a conservative approach might be better.

3. Choose Your Asset Allocation:

It involves dividing your investment among different asset categories, such as stocks, bonds, and cash. The right mix depends on your risk tolerance and investment goals.

- Stocks: Higher potential returns but more volatile, suitable for long-term growth.

- Bonds: Lower risk and returns, providing stability to your portfolio.

- Cash: Safe but offers minimal growth, useful for liquidity and short-term needs.

A common starting point for beginners is the 60/40 rule: 60% in stocks and 40% in bonds. However, you can adjust this ratio based on your personal risk tolerance.

4. Select Your Funds:

The backbone of a lazy portfolio is a set of low-cost index funds or ETFs. Here are some popular choices:

- Total Stock Market Index Fund: Provides broad exposure to the entire U.S. stock market.

- Total International Stock Market Index Fund: Offers exposure to global markets outside the U.S.

- Total Bond Market Index Fund: Covers a wide range of bonds for stability.

Some well-known funds that fit these categories include:

- Vanguard Total Stock Market ETF (VTI)

- Vanguard Total Bond Market ETF (BND)

5. Implement and Automate:

Once you've chosen your funds, it's time to invest. Most brokerage accounts offer automatic investment plans, allowing you to regularly invest a fixed amount. This simplifies the process and helps you take advantage of dollar-cost averaging, reducing the impact of market volatility.

6. Rebalance Periodically:

While a lazy portfolio requires minimal maintenance, it's essential to periodically rebalance your portfolio to maintain your desired asset allocation. Typically, this means adjusting your investments once or twice a year.

Tips for Success:

1. Stay the Course: Market fluctuations are normal and should be expected. By staying the course and maintaining a disciplined approach, you can better navigate the ups and downs of the market.

2. Educate Yourself: Continually learn about investing. The more you understand, the more confident you'll feel about your decisions. Read books, attend seminars, and follow reputable financial news sources to stay informed. By deepening your knowledge, you'll be better equipped to navigate the complexities of the market and make informed choices that align with your financial goals.

3. Use Tax-Advantaged Accounts: Maximize contributions to IRAs, 401(k)s, and other tax-advantaged accounts to enhance your returns. These accounts offer significant benefits, such as tax deferrals or deductions, which can greatly impact your long-term financial growth and retirement savings. By consistently contributing the maximum allowable amounts, you ensure that you are taking full advantage of these benefits, setting yourself up for a more secure financial future.

4. Minimize Fees: Always be mindful of fees, as they can significantly impact your returns over time. Even small fees can add up and erode your investment gains. Regularly review the fee structures of your investments and consider lower-cost options when possible to maximize your returns.

Determining the Optimal Asset Allocation:

While the 60/40 rule serves as a solid foundation for asset allocation, its important to recognize that a one-size-fits-all approach doesnt exist. Your ideal mix may vary based on factors such as risk tolerance, investment goals, and market conditions. Periodic reassessment and adjustment of your portfolio are crucial. Furthermore, as you approach retirement or other significant milestones, consider shifting to a more conservative asset allocation to safeguard your investments from market volatility.

Conclusion:

Crafting a lazy portfolio is a superb approach for novice investors to begin their financial journey. By emphasizing simplicity, low costs, and diversification, you can develop a sturdy investment strategy that demands minimal effort while delivering substantial long-term growth. Stay disciplined, rebalance your portfolio periodically, and continue educating yourself about the investment landscape. With a lazy portfolio, you can effortlessly and confidently achieve your financial objectives.

On this page

What is a Lazy Portfolio? Why Choose a Lazy Portfolio? Steps to Build Your Lazy Portfolio: 1. Determine Your Investment Goals: 2. Assess Your Risk Tolerance: 3. Choose Your Asset Allocation: 4. Select Your Funds: 5. Implement and Automate: 6. Rebalance Periodically: Tips for Success: Determining the Optimal Asset Allocation: Conclusion:

By John Davis : Oct 25, 2024

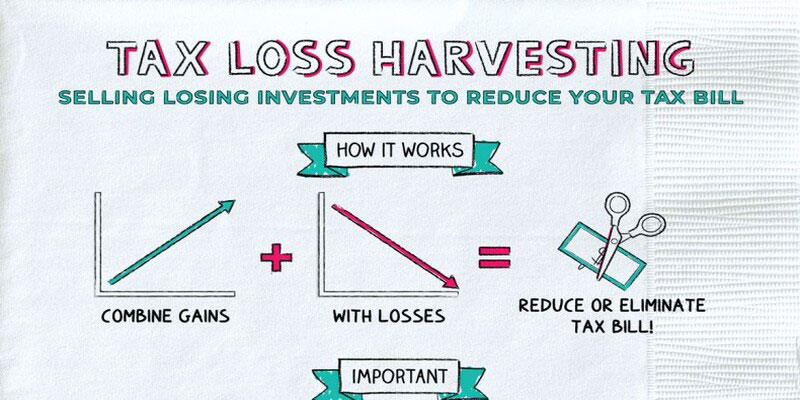

Why You May Profit From Tax-Loss Harvesting

When an investor realizes a loss on an investment, the loss can be used to offset the capital gains tax that was previously paid on a profitable investment. Incorporating this strategy into your investment approach could help you increase your portfolio's returns while decreasing your tax bill. Gaining the most from tax-loss harvesting requires investors to plan ahead regarding the timing and form of their sales, take into account the wash sales restrictions, as well as make use of tax-loss harvesting methods.

Read More

16108

By Kelly Walker : Nov 19, 2024

Is a Personal Loan Right for You? Top Reasons to Consider

Explore why taking out a personal loan could be a smart move for your finances and future. Learn about the benefits and scenarios where a personal loan could be your best option.

Read More

15737

By Kelly Walker : Dec 04, 2024

Understanding the Expenses of Nursing Home Care

Get an estimate of the typical cost for nursing home care now and know about the expenses in senior living facilities.

Read More

9371

By Rick Novak : Dec 05, 2024

Trading with Momentum: An Overview

On paper, momentum investing is less of a conscious strategy and more of a reactive response to market news. The traditional proverb on Wall Street that you should "buy cheap and sell high" runs opposite to the approach of selling underperforming companies and purchasing winning ones. This technique, which may appear enticing at first, is counterproductive

Read More

6872

By John Davis : May 18, 2025

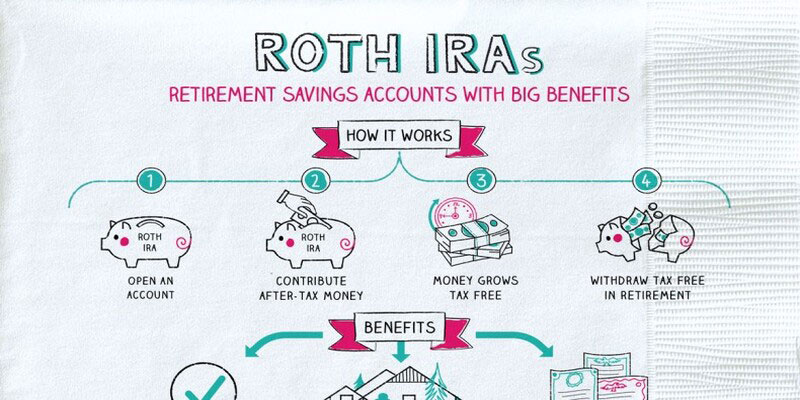

What Should You Know About Roth IRAs?

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances.

Read More

16057

By Rick Novak : Aug 01, 2024

Achieving Stock Market Mastery: Strategies for Winning Stocks

Discover how to choose winning stocks over losing ones. Practical tips for successful investing in the stock market.

Read More

15400

By John Davis : May 18, 2025

What Are The Key Differences Between Exchange-Traded Funds (ETFs) And Index Funds?

Exchange-traded funds (ETFs) and index funds allow investors to purchase a diversified portfolio of securities. While index funds are mutual funds meant to passively track a specific market index, exchange-traded funds (ETFs) are traded like individual stocks. They can be managed either passively or aggressively. ETFs typically have lower entry thresholds than index funds, and ETFs change more frequently.

Read More

16411

By Rick Novak : Aug 20, 2024

Debt and Credit Obsolescence and How to Survive It

Removing debt and credit score enhancement requires budgeting, spending only what you earn, and paying with cash or debit. Credit-checked services may also be limited

Read More

13066

By Kelly Walker : Sep 11, 2024

An Easy Guide To Postdated Checks: What You Need To Know

Learn about postdated checks: what they are, how they work, legal issues, banking, and alternatives

Read More

7700

By Kelly Walker : Aug 13, 2024

What Is Faith-Based Investing?

Learn faith-based investing, the types of investments available, and how to ensure your portfolios align with your moral beliefs and religious convictions. Get a comprehensive guide to get started on ethical investing today!

Read More

5875

By Rick Novak : Nov 29, 2024

7 Proven Strategies for Maintaining A Good Credit Rating

Secure your financial future by keeping a healthy credit score. Read our 7 strategies and start today

Read More

7329

By Rick Novak : Dec 19, 2024

Planning for Retirement: How Much Money is Enough

How Much Money You Need for Retirement: Tips for Calculating Your Savings Goal and Ensuring Financial Security in Your Golden Years

Read More

17461