Achieving Stock Market Mastery: Strategies for Winning Stocks

When investing in the stock market, knowing how to pick winning stocks over losing ones can significantly affect your portfolio's performance. While there's no foolproof formula for success, there are strategies and techniques you can employ to increase your chances of making profitable investments. This guide will explore practical tips for buying winning stocks and avoiding losing ones.

Understanding the Basics of Investing in Stocks

Before delving into the specifics of buying winning stocks, one must grasp the basics of investing in the stock market. Stocks represent ownership stakes in companies; when you invest in stocks, you become a shareholder. Your investment's worth can change because of different things, like how well the company is doing, the state of the market, and economic signals.

There are two primary approaches to buying stocks: fundamental analysis and technical analysis. Fundamental analysis means checking a company's financial health, management, industry standing, and growth potential to determine its value. On the other hand, technical analysis focuses on analyzing price trends and patterns in stock charts to forecast future price movements.

Choosing Winning Stocks Over Losing Stocks

Now that you have a basic understanding of how the stock market works let's explore some practical tips for buying winning stocks:

Research

Conducting thorough research is crucial before investing in any stock. This involves analyzing potential investment opportunities, such as the company's financial health, management team, industry position, and growth prospects. Search for companies that have strong fundamentals, such as steady earnings growth, minimal debt, and a competitive edge in their field.

Long-Term Outlook

When evaluating potential investments, focusing on the long-term prospects of the companies you're considering is essential. Look for businesses with sustainable growth potential and a clear path to increasing shareholder value over time. Assess factors such as market trends, industry dynamics, and the company's strategic initiatives to determine its long-term viability. Investing with a long-term perspective can help you ride out short-term market fluctuations and maximize your investment returns over time.

Diversification

The age-old adage "Don't put all your eggs in one basket" holds in the investing world. Diversification is a key risk management strategy that spreads your investment portfolio across different sectors, industries, and asset classes. By diversifying your investments, you can reduce the overall risk in your portfolio and minimize the impact of any stock's poor performance.

Risk Management

Assessing and managing risk is essential for successful investing. Investing in riskier stocks may lead to higher profits, but it also comes with more market fluctuations and a greater risk of losses. Balancing risk and reward based on your investment objectives and risk tolerance is crucial. Evaluate the level of risk associated with each investment opportunity and adjust your portfolio accordingly.

Avoiding Losing Stocks

In addition to selecting winning stocks, it's equally important to avoid investing in losing stocks. Here are some red flags to watch out for:

Poor Financial Health: Steer clear of companies with weak financials, such as declining revenues, mounting debt, and negative cash flow. These are signs of underlying issues that could lead to further deterioration in stock value.

Lack of Competitive Edge: Invest in companies with a sustainable competitive advantage. Avoid businesses operating in highly competitive industries without unique selling propositions or barriers to entry.

Management Issues: Pay attention to the quality of the management team. Avoid companies with a history of poor leadership, questionable decision-making, or ethical scandals.

Market Trends: Stay abreast of market trends and macroeconomic factors that could impact the companies you're invested in. Be prepared to adjust your investment strategy accordingly to navigate changing market conditions.

Applying these principles and techniques can enhance your ability to identify winning stocks and avoid losing ones in your investment portfolio. Remember that investing in the stock market carries inherent risks, and there are no guarantees of success. However, by conducting thorough research, maintaining a long-term perspective, and practicing sound risk management, you can improve your odds of achieving financial success in the stock market.

Navigating Market Trends and Cycles

Market trends and cycles can have a significant impact on stock performance, making it essential for investors to stay informed and adaptable. Here are some key points to consider:

Economic Indicators: Keep an eye on key economic indicators, such as GDP growth, inflation rates, and unemployment figures. These signs give important clues about how well the economy is doing and how it might affect the stock market.

Sector Rotation: Be aware of sector rotation trends, where investors rotate their investments between sectors based on changing market conditions. You can adjust your investment strategy by identifying sectors poised for growth and those facing headwinds.

Market Cycles: Understand the various stages of the market cycle, including bull markets, bear markets, and periods of consolidation. Each stage presents unique opportunities and challenges for investors, requiring different strategies to navigate effectively.

Technical Analysis: Utilize technical analysis techniques to identify trends and patterns in stock price movements. Using charting tools and technical indicators can assist you in understanding market sentiment and making well-informed trading choices.

Global Events: Stay informed about geopolitical events, global economic trends, and policy changes that could impact financial markets. Events such as elections, trade negotiations, and central bank decisions can have far-reaching effects on stock prices.

Investors can adapt their strategies to capitalize on opportunities and mitigate risks by staying attuned to market trends and cycles. Identifying emerging sectors, timing market entries and exits, or managing portfolio allocations, a thorough understanding of market dynamics is essential for long-term investment success.

Conclusion

Investing in the stock market can be rewarding, but it requires careful consideration and strategic decision-making. By prioritizing the selection of winning stocks over losing ones, you can increase your chances of building a profitable investment portfolio. Conduct thorough research, focus on long-term prospects, diversify your investments, and manage risk effectively. With diligence and discipline, you can navigate the complexities of the stock market and achieve your financial goals.

By John Davis : May 18, 2025

What Are The Key Differences Between Exchange-Traded Funds (ETFs) And Index Funds?

Exchange-traded funds (ETFs) and index funds allow investors to purchase a diversified portfolio of securities. While index funds are mutual funds meant to passively track a specific market index, exchange-traded funds (ETFs) are traded like individual stocks. They can be managed either passively or aggressively. ETFs typically have lower entry thresholds than index funds, and ETFs change more frequently.

Read More

7262

By John Davis : May 18, 2025

How To Stay On Track With Your Financial Plan Resolves For The New Year

New Year's financial resolutions are more likely to be kept if they involve setting realistic and measurable goals, creating a budget, automating savings, reducing debt, boosting income, reviewing insurance, seeking professional guidance, and keeping motivation levels high. If you follow these steps, you'll be on your way to building the financially stable future you've always imagined.

Read More

19420

By Rick Novak : Nov 03, 2024

Unlocking the Path to Credit Repair

Understand the detailed process to eliminate a charge-off from your credit report and boost your credit score properly.

Read More

14907

By Rick Novak : Aug 14, 2024

The Pros and Cons of Holding a Day Trading Position Overnight

Should you hold a day trading position overnight? Explore the risks and potential rewards of overnight trading in this informative article.

Read More

537

By Rick Novak : Jan 06, 2025

5 Top VA Loan Lenders

Explore the best VA loan lenders to find out about top choices so you can make better decisions for financial assistance.

Read More

15487

By Rick Novak : Aug 01, 2024

Achieving Stock Market Mastery: Strategies for Winning Stocks

Discover how to choose winning stocks over losing ones. Practical tips for successful investing in the stock market.

Read More

12855

By Rick Novak : Aug 20, 2024

Debt and Credit Obsolescence and How to Survive It

Removing debt and credit score enhancement requires budgeting, spending only what you earn, and paying with cash or debit. Credit-checked services may also be limited

Read More

14388

By Kelly Walker : Dec 17, 2024

Price vs. Stock Value: What's the Difference?

The price of the stock is what you actually pay for it. However, value is an intrinsic feature of an asset.

Read More

6492

By Rick Novak : Oct 26, 2024

How to Tackle Your Student Loans Without Stress: An Ultimate Guide

Do you want to discover effective strategies for managing your student loans? Give this article a read to learn how to plan your repayments, explore refinancing options, and avoid default.

Read More

11541

By Rick Novak : Aug 02, 2024

How to Build the Best Lazy Portfolio: A Beginner's Guide

Learn how to create a lazy portfolio with our beginner-friendly guide. Find out about asset allocation, fund selection, and tips for long-term success.

Read More

5677

By John Davis : May 18, 2025

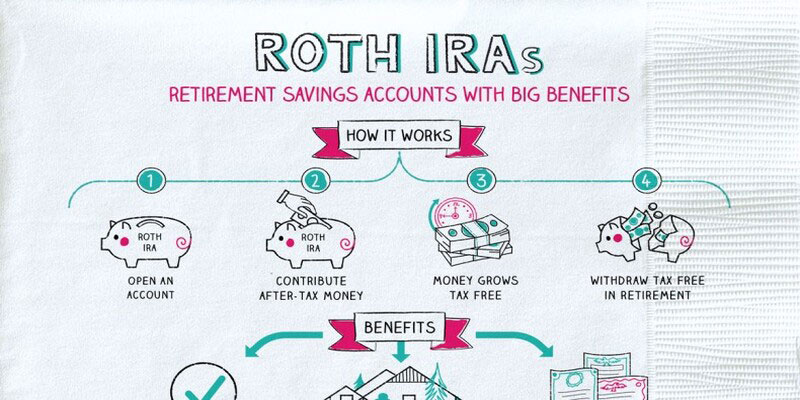

What Should You Know About Roth IRAs?

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances.

Read More

11721

By Kelly Walker : Aug 13, 2024

What Is Faith-Based Investing?

Learn faith-based investing, the types of investments available, and how to ensure your portfolios align with your moral beliefs and religious convictions. Get a comprehensive guide to get started on ethical investing today!

Read More

5493