Unlocking the Path to Credit Repair

On the credit report, a charge-off can be seen as a serious problem that affects your credit score and chances for financial opportunities. Knowing how to erase this is very important because it helps you in improving your financial health and trustworthiness. In this article, we will talk about the procedure of removing a charge-off from your credit report. This will enable you to manage your financial future.

Understanding Charge-Offs and Their Impact

Charge-off is a term used by creditors when they remove a debt from their books because it has become uncollectible. Usually, this happens after about 180 days of non-payment. Even though the creditor does not continue with efforts to collect, having charge-off status significantly affects your credit score and financial standing. Lenders see charge-offs as proof that you can't or don't want to pay back debts, which makes getting new credit difficult and may result in less favorable borrowing conditions for future loans or other financial arrangements.

If a creditor charges off your debt, it does not mean you are free from paying it. The debt remains and can gather more interest and fees, making your financial condition worse if you do not handle it properly.

- Interest Accumulation: Despite being charged off, the debt may still accumulate interest, exacerbating your financial burden.

- Credit Impact: Even after the charge-off, the negative impact on your credit score persists until the item is resolved or removed.

Checking Your Credit Report

Firstly, to start the process of removing a charge-off, you should get a credit report from all three main credit bureaus: Equifax, Experian, and TransUnion. Look at each report carefully to find any charge-offs and check if they are correct. Sometimes there may be differences or wrong details in reporting, so it is your task to make sure that your credit report shows accurate information.

Don't forget to check the charge-off's details too, like what you owe, when it was charged off and who is the creditor. If there are any differences in these details, they might help you later when disputing this item.

- Document Verification: Cross-reference the information on your credit report with any documentation you have regarding the charged-off account to ensure accuracy.

- Statute of Limitations: Familiarize yourself with the statute of limitations for debt collection in your state, as it can affect your options for resolving the charge-off.

Initiating Dispute Procedures

After you find a charge-off in your credit report, the following move is to start the disagreement process with the credit bureau that has reported this information. You can file an argument online send it by mail or even talk over the phone, giving proof to support your claim. This evidence might be payment history, talk with creditors, or proof of identity theft - all depending on the situation related to the charge-off.

Put together all the evidence you have, making sure it is complete and understandable. Clearly explain why you believe the charge-off is wrong or must be taken off. The stronger your case, the better chance you have of getting rid of this charge-off from your credit report.

- Clear Explanation: Provide a clear and concise explanation of why you believe the charge-off is inaccurate or should be removed.

- Timely Submission: Ensure that you submit your dispute within the timeframe specified by the credit bureau to avoid any delays in processing.

Negotiating a Settlement

Sometimes, you could discuss with the creditor and find an agreement to erase the charge-off from your credit report. Contact the person or collection agency managing this debt and propose a settlement offer. Be ready to bargain about conditions that are good for both parties, like paying part of what you owe in return for deleting this mark from your credit report. Ensure that any settlement agreement is documented in writing before making any payments.

Think about how a settlement might affect your finances and credit rating. Even if getting rid of the debt brings temporary relief, you must think carefully about lasting outcomes. Make sure that any deal reached is both beneficial for you in the long run and manageable to maintain.

- Impact on Credit Score: Understand that settling the debt may still result in a negative mark on your credit report, albeit less severe than a charge-off.

- Payment Terms: Clarify the terms of the settlement agreement, including the amount to be paid, the timeline for payment, and any conditions for removal of the charge-off.

Seeking Professional Assistance

The process of removing a charge-off from your credit report can sometimes be complicated and take much time. If you find it hard to make headway on your own or have difficulties along the path, think about getting help from an established credit repair company or financial advisor. These experts are skilled in fixing credit problems and can give you useful advice and direction that suit your specific circumstances.

Check the qualifications and reputation of a credit repair company or financial advisor before you seek their assistance. Be cautious about companies that make promises of fast fixes or results guaranteed, these might be signs of a scam.

- Credibility Check: Research the credentials and reputation of any credit repair company or financial advisor before seeking their assistance.

- Scam Awareness: Be cautious of companies that make unrealistic promises or charge exorbitant fees upfront, as these may be signs of a scam.

Monitoring Your Progress

When you start the dispute or agreement for solving the issue, it is very important to carefully follow how things are going. Track all communications with credit bureaus and creditors, saving each message and any changes in your credit report. Show patience and keep trying because removing a charge-off might not happen quickly; there could be delays or difficulties during this process of improvement. Stay proactive and continue to advocate for the resolution you seek.

Keep an eye on your credit report. Look for modifications or new details regarding the disputed charge-off. Make sure any solutions you agreed upon are correctly shown, and if there are differences contact the credit agencies or lenders to fix them. Keep checking regularly, as this is very important to make sure your attempts for charge-off removal work out well.

- Regular Monitoring: Continuously monitor your credit report for updates and changes related to the disputed charge-off.

- Follow-Up Communication: Be prepared to follow up with credit bureaus or creditors if discrepancies or delays occur during the resolution process.

Conclusion

After the charge-off is taken off from your credit report, you can expect a big change in both your credit score and financial situation. When this bad entry disappears, it will lighten up the load on your credit history allowing for more chances to get loans or other forms of credit with better terms like lower interest rates. You may also see an increase in stability regarding money matters such as being able to keep jobs longer because you're not worried about old debts anymore. Make sure that you continue using good habits related to borrowing money so that this progress remains intact throughout many upcoming years.

By Rick Novak : Dec 29, 2024

Things to Know Before Buying a Short Sale on a House

Check the property's value and the home for damage before buying shop board shorts on sale. Short sales may also require quick action.

Read More

13199

By Kelly Walker : Nov 17, 2024

Walking Away from a Home and Mortgage: A Comprehensive Guide

Thinking about walking away from your home and mortgage? Understand the implications, consequences, and alternatives with our comprehensive guide.

Read More

6193

By Rick Novak : Aug 20, 2024

Debt and Credit Obsolescence and How to Survive It

Removing debt and credit score enhancement requires budgeting, spending only what you earn, and paying with cash or debit. Credit-checked services may also be limited

Read More

1229

By Rick Novak : Aug 31, 2024

What Is an Income Fund?

Get the answers on income funds and learn how they can help diversify your investments. Explore all of the different types available with expert advice.

Read More

15395

By Rick Novak : Jan 06, 2025

5 Top VA Loan Lenders

Explore the best VA loan lenders to find out about top choices so you can make better decisions for financial assistance.

Read More

18338

By John Davis : Oct 25, 2024

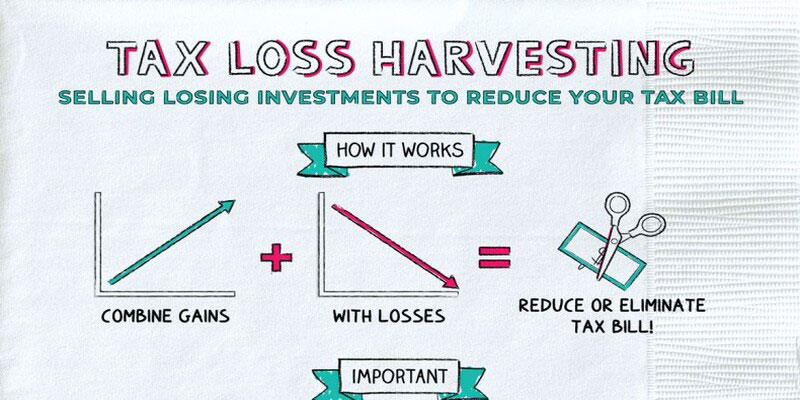

Why You May Profit From Tax-Loss Harvesting

When an investor realizes a loss on an investment, the loss can be used to offset the capital gains tax that was previously paid on a profitable investment. Incorporating this strategy into your investment approach could help you increase your portfolio's returns while decreasing your tax bill. Gaining the most from tax-loss harvesting requires investors to plan ahead regarding the timing and form of their sales, take into account the wash sales restrictions, as well as make use of tax-loss harvesting methods.

Read More

13676

By Rick Novak : Oct 26, 2024

How to Tackle Your Student Loans Without Stress: An Ultimate Guide

Do you want to discover effective strategies for managing your student loans? Give this article a read to learn how to plan your repayments, explore refinancing options, and avoid default.

Read More

5214

By Kelly Walker : Aug 05, 2024

Reasons to Avoid Index Funds

Thinking of blindly investing in index funds? Here are some potential risks to consider before you make that decision. Find out the reasons why you should avoid index funds and explore alternatives that may be a better fit for your investment needs!

Read More

5569

By Rick Novak : Aug 14, 2024

The Pros and Cons of Holding a Day Trading Position Overnight

Should you hold a day trading position overnight? Explore the risks and potential rewards of overnight trading in this informative article.

Read More

16682

By Kelly Walker : Nov 22, 2024

International Bank Account Number (IBAN): A Comprehensive Guide

IBAN number is globally used to make banking and transferring money easier and more secure. You can check it easily with your bank or online checkers.

Read More

1007

By Rick Novak : Aug 02, 2024

How to Build the Best Lazy Portfolio: A Beginner's Guide

Learn how to create a lazy portfolio with our beginner-friendly guide. Find out about asset allocation, fund selection, and tips for long-term success.

Read More

12091

By John Davis : May 18, 2025

What Are The Key Differences Between Exchange-Traded Funds (ETFs) And Index Funds?

Exchange-traded funds (ETFs) and index funds allow investors to purchase a diversified portfolio of securities. While index funds are mutual funds meant to passively track a specific market index, exchange-traded funds (ETFs) are traded like individual stocks. They can be managed either passively or aggressively. ETFs typically have lower entry thresholds than index funds, and ETFs change more frequently.

Read More

18499