Why You May Profit From Tax-Loss Harvesting

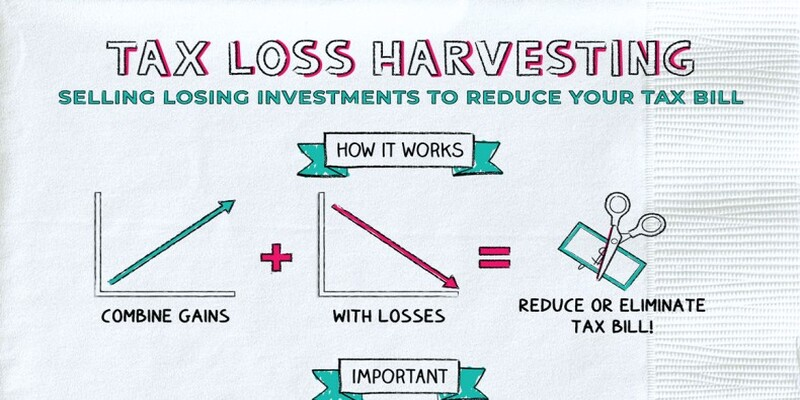

The stock market is a fantastic long-term investment vehicle, but it is not without its tax consequences. Tax-loss harvesting is a practice that can assist investors in reducing the amount of money they have to pay in taxes on their investment gains. Tax-loss harvesting aims to reduce the amount of capital gains tax owed by selling failing investments. Investors can realize losses on their investments to lessen their taxable income and, thus, their tax liability. This tactic can boost portfolio performance by selling underperforming holdings and reinvesting the proceeds in growth areas.

In addition, by proactively managing investments and thinking about tax consequences, investors can make their portfolios more tax efficient through tax-loss harvesting. Wash sale rules prohibit investors from repurchasing the same item within 30 days of selling it and experiencing a loss, so it's vital to plan when and which stocks to trade. This article will examine the advantages of tax loss harvesting for investors and how to implement it. As a whole, tax-loss harvesting is a powerful method for maximizing wealth building by reducing the drain of taxes on investment returns.

What Are Harvesting Tax Losses?

To reduce their taxable capital gains, investors might use tax-loss harvesting to liquidate underperforming holdings and reinvest the proceeds into more profitable ones. For tax purposes, this tactic might be used to recoup investment losses. Investors with large capital gains might benefit greatly from tax-loss harvesting, a strategy for mitigating the tax liability associated with investment returns.

How Does Harvesting Tax Losses Work?

Let's look at an illustration to learn how tax-loss harvesting functions. Let's pretend you've got a couple of investments: A and B. One investment, A, has brought in $10,000, while another, B, has lost $5,000. The $10,000 profit would be subject to taxation if you didn't take advantage of tax loss harvesting. You can reduce the gain from $10,000 to $5,000 if you sell Investment B and realize the loss. Your tax liability would be $5,000, the net income after deductions.

The Advantages Of Tax Loss Harvesting

Reducing Taxes

The real benefit of tax-loss harvesting is that it can drastically reduce an investor's tax liability. Realizing investment losses can reduce investors' capital gains tax liability from profitable investments. In the long run, this can mean more money in your pocket once taxes are paid.

Portfolio Performance Improvement

Through tax-loss harvesting, investors can reinvest the proceeds from the sale of underperforming holdings into other, more lucrative investments, boosting their portfolios' overall performance. Investors might boost their portfolio performance by reallocating funds from poor holdings to more promising alternatives.

Making A Tax-Affordable Portfolio

One of the many advantages of tax-loss harvesting is that it can help investors construct a portfolio that minimizes their tax liability. To get the best possible tax efficiency and return on investment, investors need to actively manage their assets and consider tax consequences when making decisions. An investor can reduce their tax liability by taking advantage of tax-loss harvesting.

Techniques For Harvesting Tax Losses

There are various techniques that investors can employ to perform tax-loss harvesting effectively:

Strategically Dispose Of Losing Investments.

When selling lost investments, it's crucial to be strategic about when you sell and which assets you trade. When deciding to sell an investment, investors must consider the time they've had it, the possibility for future gains and the total tax ramifications.

Think About Wash Sale Rules

When selling an investment at a loss, the investor cannot repurchase it for 30 days under "wash sale" regulations. When engaging in tax-loss harvesting, investors should keep these regulations in mind.

Use Software To Harvest Tax Losses.

If you're an investor interested in using tax-loss harvesting, you can do so with the help of several different software tools. These tools can streamline selling and buying and help investors spot tax-loss harvesting opportunities.

Conclusion

To sum up, tax-loss harvesting effectively reduces taxable income and increases after-tax investment returns. Successful investors know they can lower their overall tax bill, boost their portfolio's performance, and establish a tax-efficient portfolio by selling underperforming holdings to cover the capital gains tax on their successful holdings. But, tax-loss harvesting must be implemented strategically, with consideration given to when to sell, which investments to sell, and the wash sale regulations. To sum up, tax-loss harvesting is a potent tool that can aid investors in accelerating their rate of wealth creation.

On this page

What Are Harvesting Tax Losses? How Does Harvesting Tax Losses Work? The Advantages Of Tax Loss Harvesting Reducing Taxes Portfolio Performance Improvement Making A Tax-Affordable Portfolio Techniques For Harvesting Tax Losses Strategically Dispose Of Losing Investments. Think About Wash Sale Rules Use Software To Harvest Tax Losses. Conclusion

By Rick Novak : Aug 14, 2024

The Pros and Cons of Holding a Day Trading Position Overnight

Should you hold a day trading position overnight? Explore the risks and potential rewards of overnight trading in this informative article.

Read More

14521

By Kelly Walker : Aug 05, 2024

Reasons to Avoid Index Funds

Thinking of blindly investing in index funds? Here are some potential risks to consider before you make that decision. Find out the reasons why you should avoid index funds and explore alternatives that may be a better fit for your investment needs!

Read More

3050

By Rick Novak : Aug 02, 2024

How to Build the Best Lazy Portfolio: A Beginner's Guide

Learn how to create a lazy portfolio with our beginner-friendly guide. Find out about asset allocation, fund selection, and tips for long-term success.

Read More

9756

By Rick Novak : Dec 24, 2024

"Top Line vs. Bottom Line: Key Indicators of Financial Performance"

Explore key strategies for analyzing and enhancing your company's financial health through top and bottom line growth and strategic planning.

Read More

18422

By Rick Novak : Aug 01, 2024

Achieving Stock Market Mastery: Strategies for Winning Stocks

Discover how to choose winning stocks over losing ones. Practical tips for successful investing in the stock market.

Read More

6519

By Rick Novak : Aug 31, 2024

What Is an Income Fund?

Get the answers on income funds and learn how they can help diversify your investments. Explore all of the different types available with expert advice.

Read More

11285

By Rick Novak : Nov 03, 2024

Unlocking the Path to Credit Repair

Understand the detailed process to eliminate a charge-off from your credit report and boost your credit score properly.

Read More

6398

By Kelly Walker : Aug 13, 2024

What Is Faith-Based Investing?

Learn faith-based investing, the types of investments available, and how to ensure your portfolios align with your moral beliefs and religious convictions. Get a comprehensive guide to get started on ethical investing today!

Read More

3736

By Kelly Walker : Dec 17, 2024

Price vs. Stock Value: What's the Difference?

The price of the stock is what you actually pay for it. However, value is an intrinsic feature of an asset.

Read More

3780

By Rick Novak : Oct 26, 2024

How to Tackle Your Student Loans Without Stress: An Ultimate Guide

Do you want to discover effective strategies for managing your student loans? Give this article a read to learn how to plan your repayments, explore refinancing options, and avoid default.

Read More

16491

By John Davis : May 18, 2025

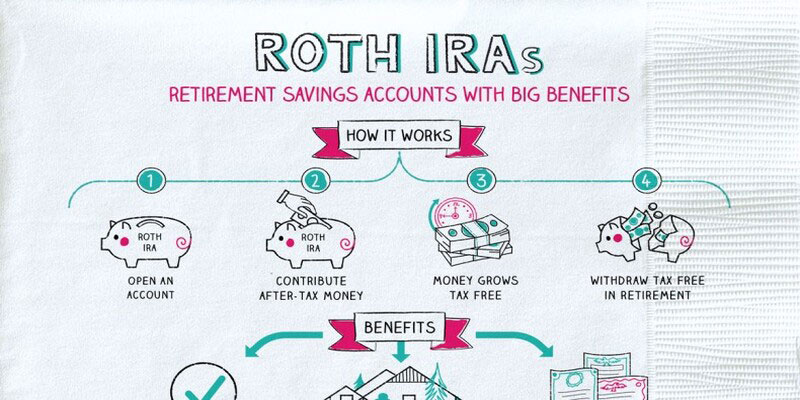

What Should You Know About Roth IRAs?

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances.

Read More

4902

By Kelly Walker : Nov 22, 2024

International Bank Account Number (IBAN): A Comprehensive Guide

IBAN number is globally used to make banking and transferring money easier and more secure. You can check it easily with your bank or online checkers.

Read More

15390