Price vs. Stock Value: What's the Difference?

Investors in stocks frequently attempt to reconcile the discrepancy between the price and value of a stock. These variables can affect a lot of moves. If you've experienced time putting money into the stock market, you know that price and value are two distinct metrics determined by different methods.

This idea gained attention after the 2008 real estate crash. That was all the marketplace was willing to pay, so many homes with values based on appraisals or other methods sold for much less.

What Factors into the Value of a Stock?

A company's (represented by a stock's) value is derived from essential elements such as:

Profits

Profitability, or earnings, is frequently used to gauge a company's performance. Figures from the past and present show how profitable a business has been so far, and earnings estimates for the future assist investors in estimating possible performance in the future. This is important to stockholders because a company's earnings are usually reinvested in the company or given to investors in the form of dividends.

Market Part

Strong market share companies have economic moats as a barrier against rivals. These moats can provide cost advantages or shield an organization from new competitors, boosting the company's appeal to investors.

P/E Ratio and Additional Measures

One popular metric for company valuation is the price-to-earnings (P/E) ratio. It calculates the price of a business based on its profit per share. A company may be undervalued if its P/E ratio is low compared to its competitors.

Rivals (Potential and Current)

A company's relative strength can be determined by comparing it to its competitors. Value disparities between competitors may be discovered by an investor, offering possible investment opportunities.

What Affects Stock and its price?

A different set of factors usually affect the stock:

Demand from Investors

The price of an investment is determined mainly by supply and demand. The market price of a stock will increase when more people enter the market and purchase it. The cost of a stock may decrease if there are more sellers than buyers.

General Market Patterns

Primary markets, such as bull and bear markets, can affect how much a stock's price performs. Other shorter market trends include rallies and directional turnarounds, typically lasting two to eight weeks.

Reports from analysts and the media

Investor behavior may be influenced by media reports about a company's controversy, leading to sales. On the other hand, a high analyst rating could persuade investors to purchase.

Financial Aspects

It has been demonstrated that six macroeconomic factorsaccurate fees, economic expansion, money, price inflation, new markets, and creditexplain 90% of the fluctuations in stock prices across all asset classes.

Business Updates

A company's quarterly earnings announcements may have an impact on investor demand. For example, if Apple's earnings beat estimates, the company's stock price might increase following the release.

Many of the factors that affect the price in the short run are determined by outside factors. However, fundamental elements like earnings or profit margins frequently take center stage over time.

Making the most of Variations in value and price

The most efficient investment method is finding value gaps between cost and value. Because companies are often overvalued and undervalued, investors usually lose their shirts when distinguishing between price and value.

How can you find companies being bought for less than what they are worth? The answer is to evaluate them using a set of standards that go outside the company's current asking price. These standards, which I call the "five Ms," are the following: Margin of Safety, Meaning, Moat, and Management.

The first step is to ensure the company you wish to invest in has something to you. If you make an effort, you'll comprehend it better, be more eager to learn and feel more motivated to spend money on it.

The second step is to pick a company with a moat. This suggests a business quality that keeps competitors out of the market and keeps them from stealing market share. For example, Coca-Cola is a powerful brand. Everyone makes soft drinks, but Coca-Cola is unique.

The third step is to look at the company's management. Managers are primarily responsible for running a business, so if you intend to invest in one, you must ensure their leadership is capable and dependable.

Ascertain the business's margin of safety and see if it meets all of your requirements before expressing interest. You can buy shares at this price, almost guaranteed to make a healthy profit without worrying about losing money. Numerous formulas and calculators can be used to calculate a business's margin of safety. On the other hand, the company represents an inexpensive investment opportunity if its price is comparable to or lower than the amount you arrive at.

Leveraging their gaps is that simple. Select a company you believe has sound fundamentals and can trust, and then observe if its price decreases to reflect its actual value. This enables you to buy companies at a reduced price, transfer them for an income, and make a healthy profit.

Conclusion

I hope this article cover all of your questions and now you can understand bitterly that > What is the difference between a stock's price and a stock's value? What do you mean by stock value? What is the difference between a stock's price and its intrinsic value? What is the meaning of stock price? Whether prices are rising or falling, traders thrive on price fluctuations. They predict the direction in which prices will move and then take a position in hopes of making some money if they make the right trade. Value is of greater importance to investors because it will help them make long-term decisions about purchasing or selling their holdings.

Having a long-term perspective does not imply buying and holding onto your investments because the market is subject to sudden fluctuations. Investors must evaluate the value of their stocks regularly. As a result, it is less likely that you will hold a failed stock or sell a stock with promising future growth.

The Balance doesn't offer investment or tax advice or services. The financial situation, risk tolerance, and investment goals of any particular investor are not considered when presenting this information. It may only be appropriate for some investors. Risks associated with investing include principal loss.

On this page

What Factors into the Value of a Stock? Profits Market Part P/E Ratio and Additional Measures Rivals (Potential and Current) What Affects Stock and its price? Demand from Investors General Market Patterns Reports from analysts and the media Financial Aspects Business Updates Making the most of Variations in value and price Conclusion

By Rick Novak : Dec 05, 2024

Trading with Momentum: An Overview

On paper, momentum investing is less of a conscious strategy and more of a reactive response to market news. The traditional proverb on Wall Street that you should "buy cheap and sell high" runs opposite to the approach of selling underperforming companies and purchasing winning ones. This technique, which may appear enticing at first, is counterproductive

Read More

110

By Rick Novak : Aug 01, 2024

Achieving Stock Market Mastery: Strategies for Winning Stocks

Discover how to choose winning stocks over losing ones. Practical tips for successful investing in the stock market.

Read More

12634

By Rick Novak : Dec 19, 2024

Planning for Retirement: How Much Money is Enough

How Much Money You Need for Retirement: Tips for Calculating Your Savings Goal and Ensuring Financial Security in Your Golden Years

Read More

15841

By Kelly Walker : Oct 22, 2024

Navigating Your Bank Account: Tips to Dodge Insufficient Funds Fees

Ever wondered how to dodge those pesky insufficient funds fees? Find practical strategies to keep your finances on track in this straightforward guide.

Read More

16348

By Kelly Walker : Aug 19, 2024

The Social Security Trust Fund: What You Should Know

Social trust finance manages surplus contributions to ensure elderly and disabled people get scheduled income funded by payroll taxes.

Read More

17648

By Kelly Walker : Dec 04, 2024

Understanding the Expenses of Nursing Home Care

Get an estimate of the typical cost for nursing home care now and know about the expenses in senior living facilities.

Read More

5644

By Kelly Walker : Nov 17, 2024

Walking Away from a Home and Mortgage: A Comprehensive Guide

Thinking about walking away from your home and mortgage? Understand the implications, consequences, and alternatives with our comprehensive guide.

Read More

9979

By Rick Novak : Aug 20, 2024

Debt and Credit Obsolescence and How to Survive It

Removing debt and credit score enhancement requires budgeting, spending only what you earn, and paying with cash or debit. Credit-checked services may also be limited

Read More

2717

By Kelly Walker : Dec 08, 2024

Using A Tax Break For Your Second Mortgage Payments

The federal government is aware that, for many people in the United States, securing a mortgage will be the most significant long-term financial commitment they will ever make. Because of a provision established by the Internal Revenue Agency, the interest you pay on your mortgage can be deducted from the taxes you owe

Read More

3700

By Rick Novak : Aug 31, 2024

What Is an Income Fund?

Get the answers on income funds and learn how they can help diversify your investments. Explore all of the different types available with expert advice.

Read More

14384

By John Davis : May 18, 2025

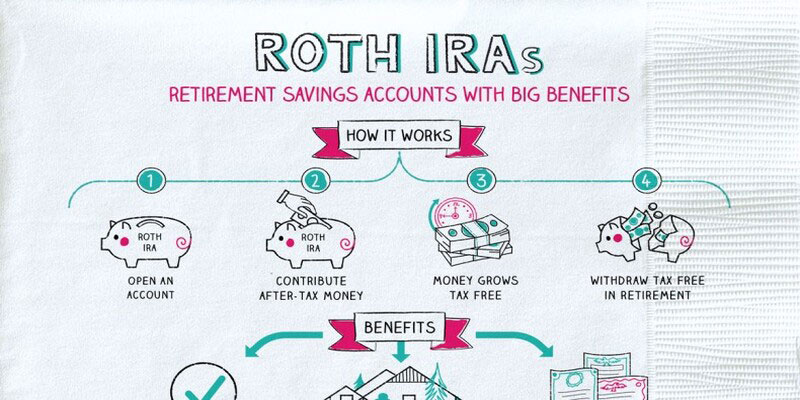

What Should You Know About Roth IRAs?

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances.

Read More

4891

By Rick Novak : Nov 29, 2024

7 Proven Strategies for Maintaining A Good Credit Rating

Secure your financial future by keeping a healthy credit score. Read our 7 strategies and start today

Read More

5929