What Should You Know About Roth IRAs?

Saving for retirement is a crucial aspect of any sound financial plan. An increasing proportion of the population is reaching retirement age, making it more important than ever to have sufficient savings to get through their later years. Individual retirement accounts are a common vehicle for retirement savings. (IRA). Individual Retirement Accounts (IRAs) are tax-advantaged savings vehicles for those planning for retirement. Traditional and Roth IRAs are the two most common varieties. The purpose, tax advantages, contribution restrictions, and withdrawal rules of Roth IRAs are all covered in this article.

What Is A Roth IRA?

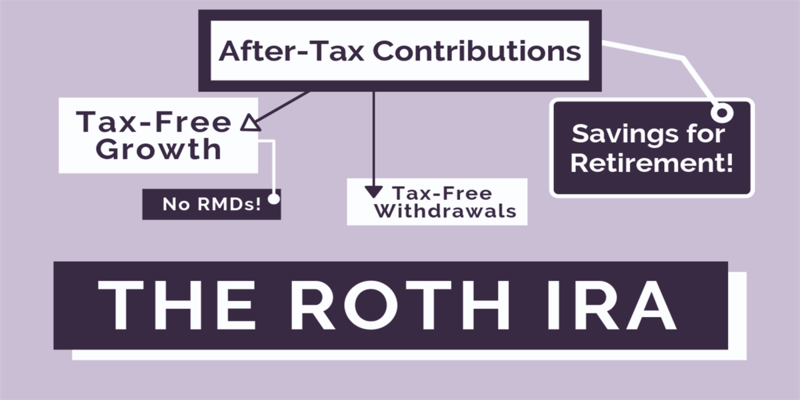

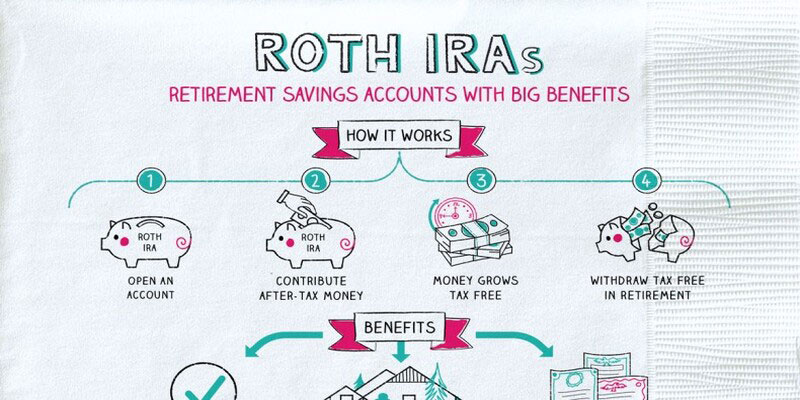

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. The money you put into a Roth IRA won't save you any taxes in the future. However, withdrawals that meet the criteria set forth by the IRS are free of taxation. That implies the money put into the account by investors is taxed, but the money taken out during retirement is not.

What's The Point Of A Roth IRA?

With a Roth IRA, your contributions are made after taxes have already been deducted. Investors are subject to taxation on the sums they deposit into the account. Stocks, bonds, mutual funds, and exchange-traded funds are only some investment options available once the funds have been deposited. (ETFs). Any earnings on investments maintained in a Roth IRA are not taxed, nor are distributions meeting certain criteria. In other words, neither the investors' payments nor their withdrawals in retirement will be subject to taxation.

What Are The Advantages Of A Roth IRA?

For those who anticipate being in a higher tax band in retirement, the particular tax advantages a Roth IRA offers may make it a desirable investment vehicle. A few examples of these advantages are:

- Withdrawals from a Roth IRA that meet certain criteria are tax-free. As a result, retirees can use their savings without incurring any tax liability.

- Investments in a Roth IRA grow without the investor paying any taxes on the earnings. As a result, investors won't be liable for paying taxes on their investment profits.

- Required minimum distributions (RMDs) do not apply to Roth IRAs at any time throughout the account holder's life. The money can stay in the account for as long as the investor likes, allowing the investment to grow tax-free.

What Are The Limits On How Much You Can Put Into A Roth IRA?

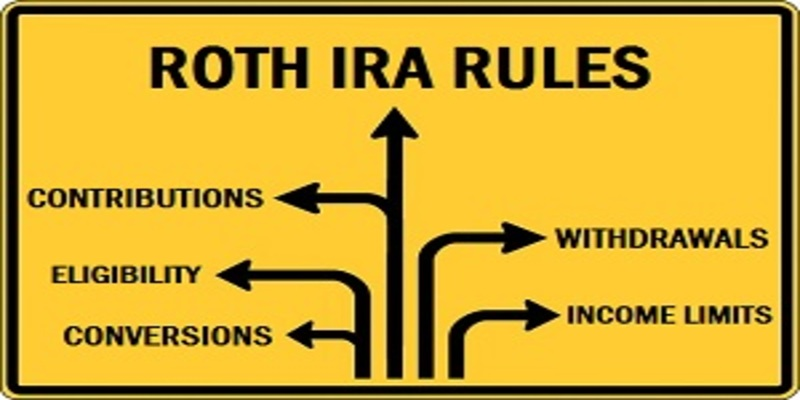

The maximum amount an investor can put into a Roth IRA each year is based on their age and income level. Individuals under 50 have a $6,000 contribution cap for the 2023 tax year. A person can contribute a maximum of $7,000 if they are 50 or older. The maximum amount you can contribute depends on your income level. A single filer's ability to make contributions is eliminated for individuals with a modified adjusted gross income (MAGI) of $150,000 or more, and it begins to taper down at $140,000. The contribution ceiling starts to decrease for joint filers with a MAGI of $208,000, and it disappears entirely for those with a MAGI of $218,000. An individual's earned income is subtracted from their Roth IRA contribution. For instance, a person with an annual income of $4,000 would be unable to make a Roth IRA contribution in excess of that amount.

What Are The Roth IRA Withdrawal Rules?

Rules and regulations govern Roth IRA withdrawals. Tax-free distributions from a Roth IRA are possible under two circumstances:

- If the account holder is 60 or older, or if the account holder has a disability,

- Withdrawal occurs once a holding term of five years has elapsed.

- The leave could be taxed and penalized if the account holder does not meet these requirements.

- The general restrictions for cashing out a Roth IRA are subject to several exemptions. For instance, in the event of the account holder's disability, they may be able to access their funds free of charge. In addition, the account user may be eligible to make a penalty-free withdrawal to cover certain costs associated with higher education or a first-time home purchase.

- Remember that any withdrawals you make from your Roth IRA may affect your eligibility for certain government benefits or subsidies. Before taking money out of a Roth IRA, people should talk to a financial counselor or tax expert.

Conclusion

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances. Furthermore, Roth IRAs are a versatile and tax-efficient retirement savings vehicle because there are no RMDs required during the account holder's lifetime. To make an informed decision about a Roth IRA, research the account's contribution limitations, withdrawal policies, and tax advantages. It is recommended that potential investors seek the advice of a financial counselor or tax expert before deciding whether or not a Roth IRA is the best retirement savings vehicle for them.

By Kelly Walker : Aug 05, 2024

Reasons to Avoid Index Funds

Thinking of blindly investing in index funds? Here are some potential risks to consider before you make that decision. Find out the reasons why you should avoid index funds and explore alternatives that may be a better fit for your investment needs!

Read More

1131

By Kelly Walker : Nov 19, 2024

Is a Personal Loan Right for You? Top Reasons to Consider

Explore why taking out a personal loan could be a smart move for your finances and future. Learn about the benefits and scenarios where a personal loan could be your best option.

Read More

16448

By Rick Novak : Aug 14, 2024

The Pros and Cons of Holding a Day Trading Position Overnight

Should you hold a day trading position overnight? Explore the risks and potential rewards of overnight trading in this informative article.

Read More

14463

By Kelly Walker : Aug 19, 2024

The Social Security Trust Fund: What You Should Know

Social trust finance manages surplus contributions to ensure elderly and disabled people get scheduled income funded by payroll taxes.

Read More

17840

By John Davis : May 18, 2025

What Should You Know About Roth IRAs?

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances.

Read More

4384

By Kelly Walker : Dec 17, 2024

Price vs. Stock Value: What's the Difference?

The price of the stock is what you actually pay for it. However, value is an intrinsic feature of an asset.

Read More

3402

By Rick Novak : Dec 24, 2024

"Top Line vs. Bottom Line: Key Indicators of Financial Performance"

Explore key strategies for analyzing and enhancing your company's financial health through top and bottom line growth and strategic planning.

Read More

9640

By Rick Novak : Nov 02, 2024

How do you calculate interest on a loan?

To determine the interest payment, multiply the monthly rate of interest by the amount of outstanding loan balance.

Read More

10025

By Rick Novak : Oct 10, 2024

Explaining Trailing Stop Loss in Day Trading

How a trailing stop loss can help you in day trading. Learn how it protects your profits and reduces losses in fast-moving markets.

Read More

7572

By Kelly Walker : Nov 17, 2024

Walking Away from a Home and Mortgage: A Comprehensive Guide

Thinking about walking away from your home and mortgage? Understand the implications, consequences, and alternatives with our comprehensive guide.

Read More

17399

By Rick Novak : Aug 20, 2024

Debt and Credit Obsolescence and How to Survive It

Removing debt and credit score enhancement requires budgeting, spending only what you earn, and paying with cash or debit. Credit-checked services may also be limited

Read More

10498

By Kelly Walker : Oct 22, 2024

Navigating Your Bank Account: Tips to Dodge Insufficient Funds Fees

Ever wondered how to dodge those pesky insufficient funds fees? Find practical strategies to keep your finances on track in this straightforward guide.

Read More

9809