How do you calculate interest on a loan?

Lenders can charge interest in two ways: simply and according to an amortization schedule. With an amortizing loan, the amount allotted to the headteacher balance will rise over time, while the portion of every instalment designated for interest will decrease. The interest rate applied to all of the monthly payments for a loan with simple interest stays constant for the duration of the loan. The two forms of accrual will have different methods for determining the total interest charges. After reading this article, you will learn the formula for calculating interest on a loan. How do I calculate my loan interest rate? What is the formula for interest? How do you calculate the monthly interest rate?

How to figure out a loan's simple interest

With the correct data, calculating loan interest if a lender employs the standard interest method is straightforward. To determine your total interest expenses, you must know your principal, the loan amount, the interest rate, and the loan term.

Although your recurring payment is set, the interest you will pay is determined by the amount of principal that is still owed. Therefore, provided the lender does not impose a prepayment penalty, you can save significant money on interest if you collect the loan early.

Simple interest calculation formula

You can use the following formula to find your total interest:

Interest is computed as the principal amount of the loan x rates of interest x loan term.

The basic interest calculation is $20,000 x.05 x 5 = five in interest if you take out a $20,000 loan with a five-year term and a five per cent interest rate.

How to figure out a loan's amortizing interest

Lenders often use an amortization schedule to determine interest rates. This covers certain auto loans as well as mortgages. These loans also have fixed monthly payments; the loan is repaid in equal instalments over time. However, over time, the lender's interest rate structure varies.

However, the primary distinction between simple interest and amortizing loans is that the former typically has higher initial payments due to interest. This implies that a lesser amount of your monthly payment is applied to your loan's principal balance.

But as time passes and your loan payback date approaches, things change. Most of the monthly payments are applied to your principal control by the lender to the end of the loan period, with less going toward interest charges.

The calculation formula for amortized interest

To find the interest for an amortized loan, follow these steps:

By the total number of payments you will make that year, divide your interest rate. You would allocate 0.06 by 12 to obtain 0.005 if you had a monthly payment schedule and an interest rate of 6%.

To calculate how much interest you'll pay each month, multiply that figure by the amount of your outstanding loan balance. The interest you pay for the first month would be $25 if your loan balance is $5,000.

To calculate the amount of principal that you will have to pay in the very initial month, deduct the interest cost from your scheduled monthly payment. If your lender has informed you that your own fixed payment every month is $430.33, the first month's payment to the principal will be $405.33. That sum is deducted from the amount you still owe.

Repeat the procedure with your remaining new loan balance for the next month, and keep doing so every month after that.

Variables that may impact the amount of interest you pay

Your interest rate on financing can vary depending on several factors. The following are the main factors that can affect the total amount you pay back throughout the loan.

Loan amount

The interest you pay a lender is largely determined by the amount you borrow or your principal loan amount. You will pay more interest because borrowing more money puts the lender at greater risk.

Your credit rating

Your credit score mostly determines the interest rate on your loan. You will usually pay more interest if your credit is better because lenders view you as a greater risk than a professional with excellent credit.

Loan duration

The time a lender allows for your payments is known as the loan term. Thus, your loan period is 60 months if you are eligible for a five-year automatic loan. On the other hand, 15- or 30-year loan terms are typical for mortgages.

Payback Schedule

When figuring out how much interest you will pay on a loan, you should also consider your lender's payment schedule. Although weekly or biweekly payments are sometimes required for business loans, most loans demand monthly payments. You can save money if you make settlements more often than once a month.

How to obtain the best interest rates on loans

There are several ways you might be able to increase your chances of getting the best possible price for interest on a loan:

- Boost your credit score: People with the best credit scores typically have access to the most affordable interest rates.

- Choose a shorter payback period: The loans with the shortest terms will always have the best rate of interest attached. If you can make the payments, you will eventually pay less interest.

- Lower the ratio of your debt to income: The monthly loans you pay as a portion of your gross monthly income are called your debt-to-income (DTI) ratio. It matters almost as much as your credit score to be eligible for an affordable loan.

- Examine offers in comparison: Every lender has a different loan product; they are not a one-size-fits-all. To guarantee the best rates, prequalify with a minimum of three different lenders. Without affecting your credit, prequalification enables you to view the terms and the rates you can get from a particular lender.

Conclusion

To fully grasp the borrowing costs, determine how much interest you'll pay on a loan before applying. Find out from the lender whether interest is calculated using an amortization schedule or the simple interest formula, then do the math using the relevant formula or an internet calculator.

Additionally, consider the elements that will influence the interest rate you pay. If you want to keep more of what you've worked for in your pocket, it might be wise to borrow a lower amount or extend the repayment period. To guarantee you get the greatest deal on a loan, you should also shop around and raise your credit score before applying.

On this page

How to figure out a loan's simple interest Simple interest calculation formula How to figure out a loan's amortizing interest The calculation formula for amortized interest Variables that may impact the amount of interest you pay Loan amount Your credit rating Loan duration Payback Schedule How to obtain the best interest rates on loans Conclusion

By Kelly Walker : Dec 08, 2024

Using A Tax Break For Your Second Mortgage Payments

The federal government is aware that, for many people in the United States, securing a mortgage will be the most significant long-term financial commitment they will ever make. Because of a provision established by the Internal Revenue Agency, the interest you pay on your mortgage can be deducted from the taxes you owe

Read More

19672

By Rick Novak : Dec 19, 2024

Planning for Retirement: How Much Money is Enough

How Much Money You Need for Retirement: Tips for Calculating Your Savings Goal and Ensuring Financial Security in Your Golden Years

Read More

4878

By John Davis : Oct 25, 2024

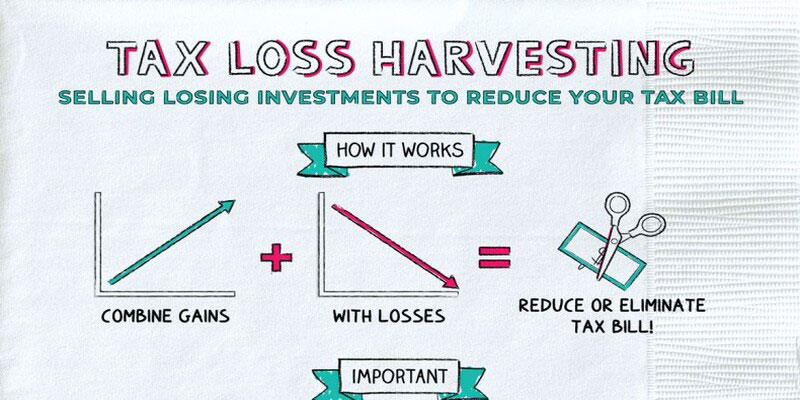

Why You May Profit From Tax-Loss Harvesting

When an investor realizes a loss on an investment, the loss can be used to offset the capital gains tax that was previously paid on a profitable investment. Incorporating this strategy into your investment approach could help you increase your portfolio's returns while decreasing your tax bill. Gaining the most from tax-loss harvesting requires investors to plan ahead regarding the timing and form of their sales, take into account the wash sales restrictions, as well as make use of tax-loss harvesting methods.

Read More

5886

By Rick Novak : Aug 01, 2024

Achieving Stock Market Mastery: Strategies for Winning Stocks

Discover how to choose winning stocks over losing ones. Practical tips for successful investing in the stock market.

Read More

17789

By Kelly Walker : Aug 19, 2024

The Social Security Trust Fund: What You Should Know

Social trust finance manages surplus contributions to ensure elderly and disabled people get scheduled income funded by payroll taxes.

Read More

17331

By Rick Novak : Nov 03, 2024

Unlocking the Path to Credit Repair

Understand the detailed process to eliminate a charge-off from your credit report and boost your credit score properly.

Read More

14568

By Kelly Walker : Aug 05, 2024

Reasons to Avoid Index Funds

Thinking of blindly investing in index funds? Here are some potential risks to consider before you make that decision. Find out the reasons why you should avoid index funds and explore alternatives that may be a better fit for your investment needs!

Read More

8520

By Rick Novak : Aug 14, 2024

The Pros and Cons of Holding a Day Trading Position Overnight

Should you hold a day trading position overnight? Explore the risks and potential rewards of overnight trading in this informative article.

Read More

5867

By John Davis : May 18, 2025

How To Stay On Track With Your Financial Plan Resolves For The New Year

New Year's financial resolutions are more likely to be kept if they involve setting realistic and measurable goals, creating a budget, automating savings, reducing debt, boosting income, reviewing insurance, seeking professional guidance, and keeping motivation levels high. If you follow these steps, you'll be on your way to building the financially stable future you've always imagined.

Read More

2381

By John Davis : May 18, 2025

What Are The Key Differences Between Exchange-Traded Funds (ETFs) And Index Funds?

Exchange-traded funds (ETFs) and index funds allow investors to purchase a diversified portfolio of securities. While index funds are mutual funds meant to passively track a specific market index, exchange-traded funds (ETFs) are traded like individual stocks. They can be managed either passively or aggressively. ETFs typically have lower entry thresholds than index funds, and ETFs change more frequently.

Read More

6807

By Kelly Walker : Sep 11, 2024

An Easy Guide To Postdated Checks: What You Need To Know

Learn about postdated checks: what they are, how they work, legal issues, banking, and alternatives

Read More

12408

By Kelly Walker : Oct 05, 2024

Potential Warnings About Index Funds

Investing in index funds can be a great way to grow your money, but there are also potential risks that should be considered. Learn what you need to know and pay attention to before making an informed decision about your finances.

Read More

17030