An Easy Guide To Postdated Checks: What You Need To Know

Have you ever received a check with a date in the future? If yes, that's what's called a postdated check. A postdated check is when the person writing the check picks a date later than today for when the check should be cashed. People do it often, especially for payments or deals that will happen later. But this raises important questions about whether it's allowed, how banks handle it, and the possible problems it might cause for both the person writing the check and the one getting it. It's important for anyone dealing with money to understand what postdated checks are all about. In this article, we'll talk about what they are, if they can be used, and how to stay safe.

How Postdated Checks Work?

When someone writes a postdated check, they give it to another person, but the date is for later, like weeks or months away. This tells the person receiving the check to cash it on that future date.

Usually, the person writing the check tells the other person clearly to wait until that date before depositing it in their bank. This helps the person writing the check manage their money better by delaying the payment until they have enough water.

Purpose And Usage Of Postdated Checks

Postdated checks have many uses, like helping people manage their money or ensuring they have enough funds later. For example, someone might write a postdated check to pay rent early, renew a subscription, or repay a loan gradually.

Similarly, businesses often use postdated checks to delay paying employees, suppliers, or contractors until a certain date which fits their financial plans or budget. This way, individuals and businesses can handle their money better, ensuring they have enough when they need it and paying what they owe on time.

Benefits And Considerations

Using postdated checks has many benefits. For people writing the checks, it helps them manage their money by delaying payments until they have enough funds. This stops situations like spending more money than they have or having a check that can't be cashed, especially if they expect to get money before the date on the check. Also, postdating checks show a promise in financial deals, proving the person plans to pay their responsibility later.

But there are things to think about and risks with postdated checks. Those getting the checks must ensure they know the date on each one to avoid accidentally trying to cash or deposit it too soon. Doing this too early could mean paying extra fees or getting into legal trouble, especially if the person who wrote the check needs more money in their account or says they didn't agree to the transaction. Both people need to understand these things when using postdated checks.

Postdated Check Rules

How postdated checks are handled by the law can change depending on where you are and the situation. In some places, like certain countries or states, giving a postdated check before the date written on it might be seen as against the law or not right because it breaks the agreement between the person writing the check and the one receiving it. However, in other areas, banks usually take postdated checks as long as they're shown on or after the date listed.

The person writing the check and the receiver must know their rights and duties under the law. While putting a future date on a check doesn't always stop it from being cashed or deposited early, it might give some legal protection to the person writing the check if the one getting it tries to use it too soon. Still, arguments about postdated checks can happen and need to be settled by agreement or going to court.

Banks And Postdated Checks

Banks play a major role in dealing with postdated checks. The bank looks at the date when someone tries to put in or get cash for a postdated check. They'll usually tell the person they can only do something with the check once that date comes. But banks don't have to wait, and some might go ahead and deal with the check, especially if the person who wrote it has enough money in their account.

It's really important for people and businesses when giving out postdated checks to talk clearly with their bank and the person getting the check. This helps everyone know when the check can be used and what's expected. Good agreements can stop problems like not understanding, fighting, or unexpected things happening because postdated checks are used in deals.

Alternatives To Postdated Checks

Even though postdated checks can help pay bills and manage money, other ways might be simpler. Sending money electronically, paying bills automatically, and setting up payments online are good choices. They let you plan payments for later without using paper checks.

These ways are often faster, easier, and safer than postdated checks. You don't have to wait for checks to be cashed or worry about dates. So, while postdated checks can be acceptable, these other options might be better for some people and businesses. They give a more up-to-date and effective way to pay bills and manage money.

Conclusion

In short, postdated checks are useful for managing money, planning payments, and feeling secure in financial transactions. However, they also have risks for both the person writing the check and the one receiving it, especially regarding legal matters and how banks handle them.

Understanding how postdated checks work, why they're used, their benefits, and other payment options can help individuals and businesses make wise decisions about using them in their financial affairs. Effective communication, clear agreements, and careful money handling are essential to maximize postdated checks while avoiding issues.

By John Davis : May 18, 2025

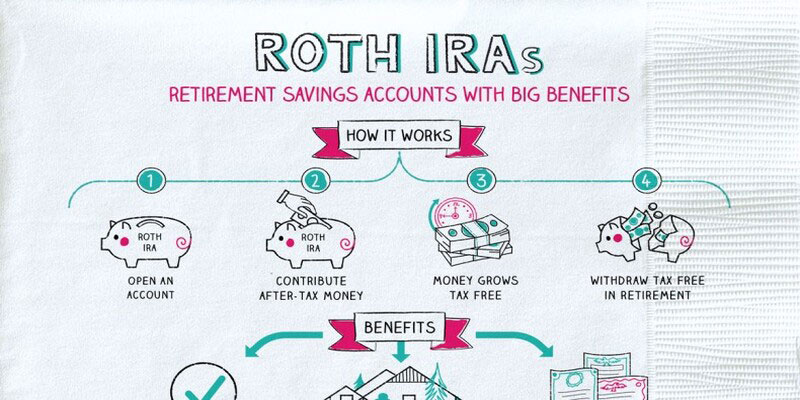

What Should You Know About Roth IRAs?

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances.

Read More

11996

By John Davis : May 18, 2025

What Are The Key Differences Between Exchange-Traded Funds (ETFs) And Index Funds?

Exchange-traded funds (ETFs) and index funds allow investors to purchase a diversified portfolio of securities. While index funds are mutual funds meant to passively track a specific market index, exchange-traded funds (ETFs) are traded like individual stocks. They can be managed either passively or aggressively. ETFs typically have lower entry thresholds than index funds, and ETFs change more frequently.

Read More

7424

By Kelly Walker : Sep 11, 2024

An Easy Guide To Postdated Checks: What You Need To Know

Learn about postdated checks: what they are, how they work, legal issues, banking, and alternatives

Read More

4696

By Kelly Walker : Aug 13, 2024

What Is Faith-Based Investing?

Learn faith-based investing, the types of investments available, and how to ensure your portfolios align with your moral beliefs and religious convictions. Get a comprehensive guide to get started on ethical investing today!

Read More

17577

By Rick Novak : Aug 31, 2024

What Is an Income Fund?

Get the answers on income funds and learn how they can help diversify your investments. Explore all of the different types available with expert advice.

Read More

8793

By Kelly Walker : Nov 19, 2024

Is a Personal Loan Right for You? Top Reasons to Consider

Explore why taking out a personal loan could be a smart move for your finances and future. Learn about the benefits and scenarios where a personal loan could be your best option.

Read More

6400

By Kelly Walker : Dec 17, 2024

Price vs. Stock Value: What's the Difference?

The price of the stock is what you actually pay for it. However, value is an intrinsic feature of an asset.

Read More

10199

By Rick Novak : Dec 27, 2024

The U.S. Treasury Yield Spread What You Need to Know

Discover what the U.S. Treasury yield spread is, how it impacts the economy and financial markets, and why it's important for investors.

Read More

3366

By Kelly Walker : Dec 08, 2024

Using A Tax Break For Your Second Mortgage Payments

The federal government is aware that, for many people in the United States, securing a mortgage will be the most significant long-term financial commitment they will ever make. Because of a provision established by the Internal Revenue Agency, the interest you pay on your mortgage can be deducted from the taxes you owe

Read More

7526

By Rick Novak : Nov 02, 2024

How do you calculate interest on a loan?

To determine the interest payment, multiply the monthly rate of interest by the amount of outstanding loan balance.

Read More

15687

By Rick Novak : Aug 20, 2024

Debt and Credit Obsolescence and How to Survive It

Removing debt and credit score enhancement requires budgeting, spending only what you earn, and paying with cash or debit. Credit-checked services may also be limited

Read More

18429

By Kelly Walker : Oct 05, 2024

Potential Warnings About Index Funds

Investing in index funds can be a great way to grow your money, but there are also potential risks that should be considered. Learn what you need to know and pay attention to before making an informed decision about your finances.

Read More

8972