Debt and Credit Obsolescence and How to Survive It

Many see debt as an inevitable evil. Yet, it is feasible to survive without borrowing money or being concerned about your credit ratings. Though the advantages of living debt-free are obvious, it's wise to be prepared for the difficulties and solutions you may find before you cut ties with credit. Some "financial gurus" say that cutting off credit entirely is the surest method to end debt consolidation and credit scores and start building money.

Living Without a Credit Card

Everyday Expenses

Simple purchases like food, entertainment, and groceries may be made with a debit card or cash. Although having cash on hand is dangerous, using the envelope approach to split money by purpose makes budgeting a breeze. Imagine the ease of a credit card with the added security of only using the money in your checking account when you attach your debit card.

Monthly Bills

It could be rather simple to stop using a credit card to get rid of debt and improve your credit score while paying for monthly expenses like mobile phone bills, utility bills, or gym subscriptions. Make the change to online bill payment so that your bank may send money to your biller by electronic transfer or cheque. For example, you may arrange for the funds to be automatically deducted with a credit card. Paying these invoices using your debit card is another option.

Prepaid Cards

Prepaid debit cards that help with debt collection and credit scores are available for people without bank accounts. Prepaid cards only work with "loaded" money. One swipe or online bill pay is available with this card. Use the whole sum to render the card unusable.

Frozen Funds

Issues arise with debit cards when the whole amount is not known when the card is swiped. This is common when you start a tab at a nightclub, hire a vehicle, or book a hotel room. The store will "lock up" the money in your bank account by pre-authorizing your card.

Even though these charges should go away in a few days, dealing with many charges at once when your checking account is low might be complicated. Money won't matter if the bank won't accept it; otherwise, your card will be refused, and your checks will bounce. Check your available balance often and have a safety net of funds in your checking account in emergencies.

Debit Card Required

Prepaid and debit cards are riskier than credit cards for daily purchases. Thieves who steal debit card information and use it for illicit activities may quickly empty your bank account. You are usually covered against fraud and mistakes, but reporting your bank immediately might strengthen your protection. Your account may be experiencing issues. A later mess may cause further issues. Credit card fraud occurs when criminals spend cardholder funds. While you remedy the problem, you may postpone using your bank account.

Most places accept debit cards even if a credit card number is required to fill out an online form. A credit card helps with debt and credit score and is often necessary to reserve an automobile rental rather than a debit card. For major purchases like automobile rentals, it's a good idea to research if certain cards are accepted or what steps you need to take if you just have a debit card.

Benefits of Not Using A Credit Card

You need to start judging your success in life by the amount of money you have in the bank. To gauge one's financial well-being, what gives? Certainly not one's debt collection and credit score. Rest assured, we didn't. Here are a few reasons why becoming credit cardless is a good choice now that you know it's possible to rent a vehicle, acquire a mortgage, and even book a hotel room:

Increased Productivity

Your productivity may suffer if you're in debt and credit scores are bad, as issues with paying off your debt could make you feel anxious and preoccupied. Having no debt means you have more mental space and time to devote to things. Brain training may also enhance an individual's professional life, decision-making abilities, and capacity for self-control.

Security Assurance

Financial health is excellent for debt-free people since their DTI is low and their credit score is good. An added benefit is credit score enhancement. Debt consolidation and credit score help you avoid energy or mobile phone deposits, lower your mortgage rate, and be seen by landlords when you apply for rentals.

Saves Money

Focus on your emergency fund and financial objectives after paying off your debt. You could plan a lavish honeymoon for a 20-year-old couple. You may be considering a new automobile. You're considering quitting early.

Being debt-free lets you save for unexpected expenses. A wise individual would save enough for three to six months. One of the numerous benefits of having an emergency fund is knowing you won't become bankrupt due to medical emergencies or job loss.

Improves Credit Score

The usage rate, total credit accounts, and available credit all affect your credit score. As your finances improve, your debt consolidation and credit score rise, which benefits you in many ways. Credit scores affect lending restrictions and interest rates. Paying off bills can boost your debt collection and credit score and prepare you for credit-based purchases like a home.

Saving Money On Interest

Auto loan interest rates never change. Though you can pay more, the total amount is final. The borrower can change credit card and other revolving loan interest rates. Credit card interest compounded, meaning it added to previous interest. Interest-based loans can cost hundreds of dollars. Debt repayment reduces compound interest, saving money over time.

Less Stress

Being deeply in debt is known to be stressful. Money management and living paycheck to paycheck can cause stress. Full debt repayment eliminates credit, bank account, and debt collector issues. It's great to feel mentally and financially free after paying off debt.

By Kelly Walker : Oct 22, 2024

Navigating Your Bank Account: Tips to Dodge Insufficient Funds Fees

Ever wondered how to dodge those pesky insufficient funds fees? Find practical strategies to keep your finances on track in this straightforward guide.

Read More

13251

By Kelly Walker : Nov 22, 2024

International Bank Account Number (IBAN): A Comprehensive Guide

IBAN number is globally used to make banking and transferring money easier and more secure. You can check it easily with your bank or online checkers.

Read More

18445

By Rick Novak : Dec 19, 2024

Planning for Retirement: How Much Money is Enough

How Much Money You Need for Retirement: Tips for Calculating Your Savings Goal and Ensuring Financial Security in Your Golden Years

Read More

9924

By Kelly Walker : Oct 05, 2024

Potential Warnings About Index Funds

Investing in index funds can be a great way to grow your money, but there are also potential risks that should be considered. Learn what you need to know and pay attention to before making an informed decision about your finances.

Read More

196

By Rick Novak : Oct 29, 2024

Crossing the Financial Bridge: A Comprehensive Bridge Loan Guide

Explore bridge loans: learn types, how they work, and examples. Discover how they bridge financial gaps effectively.

Read More

19302

By Rick Novak : Dec 29, 2024

Things to Know Before Buying a Short Sale on a House

Check the property's value and the home for damage before buying shop board shorts on sale. Short sales may also require quick action.

Read More

1512

By Rick Novak : Aug 31, 2024

What Is an Income Fund?

Get the answers on income funds and learn how they can help diversify your investments. Explore all of the different types available with expert advice.

Read More

2994

By Rick Novak : Oct 10, 2024

Explaining Trailing Stop Loss in Day Trading

How a trailing stop loss can help you in day trading. Learn how it protects your profits and reduces losses in fast-moving markets.

Read More

18384

By John Davis : Oct 25, 2024

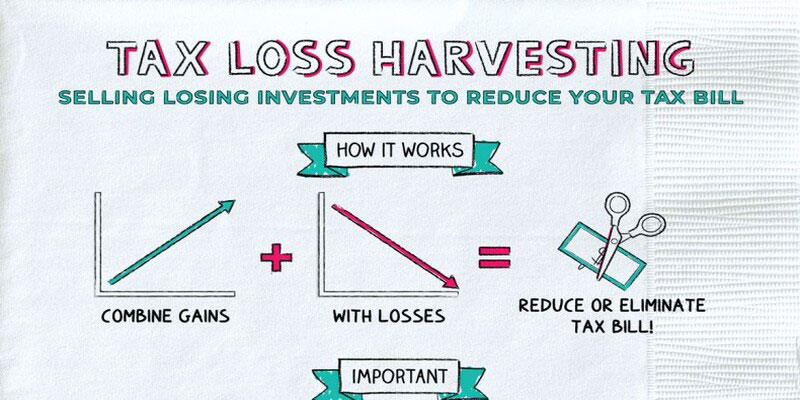

Why You May Profit From Tax-Loss Harvesting

When an investor realizes a loss on an investment, the loss can be used to offset the capital gains tax that was previously paid on a profitable investment. Incorporating this strategy into your investment approach could help you increase your portfolio's returns while decreasing your tax bill. Gaining the most from tax-loss harvesting requires investors to plan ahead regarding the timing and form of their sales, take into account the wash sales restrictions, as well as make use of tax-loss harvesting methods.

Read More

14066

By Rick Novak : Nov 03, 2024

Unlocking the Path to Credit Repair

Understand the detailed process to eliminate a charge-off from your credit report and boost your credit score properly.

Read More

5400

By Rick Novak : Aug 14, 2024

The Pros and Cons of Holding a Day Trading Position Overnight

Should you hold a day trading position overnight? Explore the risks and potential rewards of overnight trading in this informative article.

Read More

7110

By John Davis : May 18, 2025

How To Stay On Track With Your Financial Plan Resolves For The New Year

New Year's financial resolutions are more likely to be kept if they involve setting realistic and measurable goals, creating a budget, automating savings, reducing debt, boosting income, reviewing insurance, seeking professional guidance, and keeping motivation levels high. If you follow these steps, you'll be on your way to building the financially stable future you've always imagined.

Read More

9933