Things to Know Before Buying a Short Sale on a House

In the real estate market, a Short sale is an offer to buy a property for a price less than the remaining amount on the current owner's mortgage. Usually indicating financial troubles for the homeowner, a shop board shorts on sale allows them to sell the house before the lender takes ownership of it.

In short sale vs foreclosure, the lender receives all profits from short sale, unlike foreclosure. The lender then has two choices: either seek a deficiency judgment requiring the former homeowner to pay all or part of the difference or forgive the remaining sum. This pricing discrepancy can be excused in some states.

Process Of Short Sale

A short sale house acquisition will include a lot of the same procedures as any other real estate transaction in some aspects. However, you must follow a streamlined process.

Getting A Qualified Agent

Only proceed with a purchase with the assistance of an agent with expertise and experience in short-sale purchases. There are important aspects that must be taken care of right away, and your agent's expertise will be invaluable.

It would be ideal if the seller also had a realtor with expertise in short sales since this would facilitate a seamless transaction. You would benefit greatly from having an agent who is certified as a short sales agent without short sale restriction and a foreclosure resource in this transaction.

You can anticipate an even lengthier delay if many lenders are handling the property. Also, secondary lenders have a voice in this process if the short-sale property you want to buy is subject to additional liens or a second mortgage. To understand the short sale vs foreclosure and get it approved, the principal lender will need to negotiate with the other lenders.

Moreover, it can take months to reach a consensus of this kind, or it can not happen at all. Recall that in a short sale, the lender takes less money than is owed. This implies that because there are many lenders involved, they must all consent to incur a loss, which is much easier said than done.

Not Every Deal Is A Bargain

A shop board shorts on sale offer that is at least fair market value is often required in a short sale. The bank is not motivated to settle for less than what the seller originally paid, even if the true market value is much lower if the real estate market has tanked. Instead of attempting to offer you a decent deal, the bank is trying to stop losing money. Also, the bank can only consider allowing the transaction if you provide more than the fair market value.

Buying Property "As Is"

Repaired to enable the transaction to proceed, the bank holding the mortgage will not consent. To lose more money, they will not spend money. Both the seller and the buyer are likely to have the money for repairs.

In short sale vs foreclosure, a short sale would not be something they were trying to do if they had extra money. Moreover, as the inspection report is being reviewed, omitting the short sale restrictions and procedure, your agent should confirm if the terms of your offer allow you to withdraw.

Need To Pay More Upfront

You'll have to cover the cost of a home inspection if you want one done on the property, which you should do. In a short sale, the commission might get complex. Also, the lenders can have different expectations even if you and the seller have agreed on a price. You may need to make up the shortfall if the lender refuses to pay the whole commission that was agreed upon.

Look Lender-Approved Homes

Some properties can already have had lender clearance for a short sale, although these can be hard to discover. However, the buyer can later withdraw. Since the lender has already approved a short sale, it should be easier for your endeavor to proceed with fewer obstacles. Also, having a short sale vs foreclosure understanding from an agent with expertise on your side will again contribute to the success of the procedure.

Proceed With Caution

Though they are not always the best option, short sales can be a good way to become property owners. You can reap the rewards of your patience if you go cautiously and with diligence. So that your interests are safeguarded, be sure to take the time to choose a skilled agent with short-sale expertise.

Benefits Of Purchasing A Short Sale Home

Saves You Money

Short-sale properties are sold for less than the demanded amount without any short sale restriction to save you, the buyer, hundreds of dollars. The lender is keen to sell to recoup some or the whole of the seller's mortgage loan debt. Also, if you stick with it through the drawn-out and challenging process, you might have a lot.

Less Competition

The lender's participation complicates the short sale vs foreclosure procedure. Negotiations can take a long time, the lender can reject bids, and there is a lot more paperwork needed than in a regular house sale. Thus, you have less competition since the majority of prospective customers avoid them.

Potential For Equity

Because the property's value can rise over time, you can accumulate equity if you buy a short-sale home at a bargain. You can resell it for a profit in the future if you combine this with other upgrades, such as repairs. Unfortunately, since it depends on the state of the market at the moment, this cannot always be guaranteed.

Saves Credit Score

A short sale would be very helpful to sellers impacted by foreclosure without short sale restrictions. Your credit score suffers less damage from it than from the latter. You might ask the lender to note the short sale as "paid in full" or "settled," therefore helping your eligibility for the next loans.

Agreeable Vendor

Regular house sales can encounter issues with an angry seller who threatens to destroy things on purpose or won't move out. Nonetheless, a seller in a shop board shorts on sale is more amenable as they are conscious of their precarious financial condition and want to minimize the consequences of foreclosure.

On this page

Process Of Short Sale Getting A Qualified Agent Not Every Deal Is A Bargain Buying Property "As Is" Need To Pay More Upfront Look Lender-Approved Homes Proceed With Caution Benefits Of Purchasing A Short Sale Home Saves You Money Less Competition Potential For Equity Saves Credit Score Agreeable Vendor

By Rick Novak : Oct 10, 2024

Explaining Trailing Stop Loss in Day Trading

How a trailing stop loss can help you in day trading. Learn how it protects your profits and reduces losses in fast-moving markets.

Read More

15163

By Kelly Walker : Nov 19, 2024

Is a Personal Loan Right for You? Top Reasons to Consider

Explore why taking out a personal loan could be a smart move for your finances and future. Learn about the benefits and scenarios where a personal loan could be your best option.

Read More

7392

By Rick Novak : Aug 14, 2024

The Pros and Cons of Holding a Day Trading Position Overnight

Should you hold a day trading position overnight? Explore the risks and potential rewards of overnight trading in this informative article.

Read More

10790

By Kelly Walker : Oct 22, 2024

Navigating Your Bank Account: Tips to Dodge Insufficient Funds Fees

Ever wondered how to dodge those pesky insufficient funds fees? Find practical strategies to keep your finances on track in this straightforward guide.

Read More

19341

By Kelly Walker : Aug 19, 2024

The Social Security Trust Fund: What You Should Know

Social trust finance manages surplus contributions to ensure elderly and disabled people get scheduled income funded by payroll taxes.

Read More

19850

By Rick Novak : Sep 30, 2024

How Bonds Affect the Stock Market: Everything You Need to Know

This article provides a detailed overview of how bonds affect the stock market and their mutual relationship

Read More

18029

By Rick Novak : Dec 19, 2024

Planning for Retirement: How Much Money is Enough

How Much Money You Need for Retirement: Tips for Calculating Your Savings Goal and Ensuring Financial Security in Your Golden Years

Read More

11970

By Rick Novak : Nov 03, 2024

Unlocking the Path to Credit Repair

Understand the detailed process to eliminate a charge-off from your credit report and boost your credit score properly.

Read More

6299

By Kelly Walker : Dec 17, 2024

Price vs. Stock Value: What's the Difference?

The price of the stock is what you actually pay for it. However, value is an intrinsic feature of an asset.

Read More

11167

By John Davis : May 18, 2025

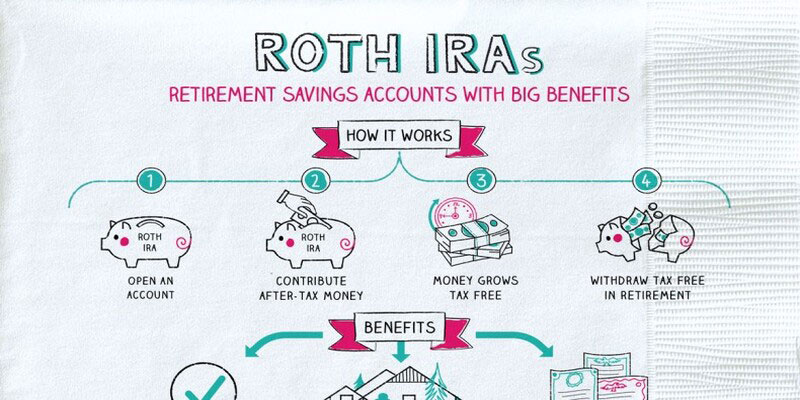

What Should You Know About Roth IRAs?

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances.

Read More

2384

By Rick Novak : Dec 05, 2024

Trading with Momentum: An Overview

On paper, momentum investing is less of a conscious strategy and more of a reactive response to market news. The traditional proverb on Wall Street that you should "buy cheap and sell high" runs opposite to the approach of selling underperforming companies and purchasing winning ones. This technique, which may appear enticing at first, is counterproductive

Read More

11910

By Rick Novak : Aug 01, 2024

Achieving Stock Market Mastery: Strategies for Winning Stocks

Discover how to choose winning stocks over losing ones. Practical tips for successful investing in the stock market.

Read More

5264