How Bonds Affect the Stock Market: Everything You Need to Know

Bonds have a major impact on the stock market. Stock prices go up when bonds go down, and stock prices go down when bonds go up. Bonds and stocks compete for investors' money since bonds are considered safer than stocks. When the economy is doing well, stocks usually fare well, too. When customers spend more money, businesses make more money because there is more demand, and investors are more at ease. When the economy performs well, buying stocks and selling bonds is one of the best methods to combat inflation. In this article, we will discuss how bonds affect the stock market.

What is a Bond?

Bonds are loans from you to any company or government. It does not involve any physical activity on your part, and there are no shares to buy. In simple words, when you buy a bond, a company or a government is getting a loan from you. And they will pay you interest on the loan for a fixed period. And it will return to you the total purchase amount of your bond after some time.

The duration of the bonds depends on the type of bonds one buys. But this period can be from a few days to 30 years. Similarly, the interest rate varies depending on the bond type and duration. There are many types of bonds, which are,

- Government Bond

- Mortgage-backed bond

- Municipal bonds

What is a Stock?

Stocks represent fractional ownership in a company. Fractional ownership means that when you buy one share of the company, you become the owner of that company, and if you buy more shares, the more you own the company. If the company is performing well and making good profits annually, then you, as the fractional owner, are also making profits. You can sell them further to earn more profit from your shares.

Relationship Between Bonds and Stocks

Stocks and bonds often have an inverse relationship with each other. When stock prices are constantly falling and during falling stock prices, investors put their money into buying low-yield bonds. By doing so, their demand increases, and their prices also increase. Sometimes, stocks and bonds go up simultaneously, which happens when too much money is chasing too little investment. It is important to understand the bond yield and stock market relationship before investing.

How does inflation affect the relationship between bonds and the stock market?

Stocks and bonds are positively correlated when inflation is high and volatile. As the relationship is positive, both prices are increasing or decreasing in the same direction. And when inflation is low, the correlation between stocks and bonds becomes negative. Investors should also consider other factors while investing as they also affect inflation.

Factors that affect the relationship between bonds and stock market

Here are some factors that affect the relationship between bonds and the stock market.

Interest rate

One of the main factors that affect both is Interest rate. It takes a full year for a change in interest rates to have a large-scale economic impact, but the interest rate reaction is rapid in the stock market. Understanding the relationship between interest rates and the stock market helps investors understand how changes affect their investments. Investors can make better financial decisions by understanding the impact of interest rates on the stock market.

Federal funds rate

The interest rate that affects the stock market is the federal funds rate. It is the interest rate that banks and credit unions charge each other for loans. On the other hand, the discount rate is the interest rate that the Federal Reserve banks charge users when they borrow collateral loans. The Federal Reserve raises or lowers the federal funds rate to control inflation. Central banks of many other countries also follow the same approach.

What happens when interest rates Rise?

When the Federal Reserve moves to raise interest rates, it immediately raises short-term borrowing costs for financial institutions. As financial institutions have to pay more to borrow money, these institutions raise the rates they charge their customers to borrow money from.

Moreover, rate hikes also affect consumers' credit cards and other items. When interest rates on credit cards and mortgages increase, the amount of money consumers spend decreases. So, as rates rise, businesses are not only affected by higher borrowing costs, but they also affect consumer demand. Both of these factors can influence earnings and stock prices.

What is the best investment when interest rates are Rising?

All economic situations are different, so there is no single best investment for all situations. Also, some investments perform better. Also, some investments perform better when interest rates are rising. If you're reading rates in response to inflation, you may also want to consider buying inflation-specific government bonds. But be sure to seek guidance from your financial advisor before investing.

What happens when the interest rate falls?

The Federal Reserve lowers the federal funds rate to stimulate monetary activity when the economy slows. Interest rate cuts by the Federal Reserve have the opposite effect of rate hikes. Investors consider low-interest rates a strong support for growth because low-interest rates lead to higher profits and a stronger economy.

However, some sectors benefit from rising interest rates. The financial industry benefits more from rising interest rates. And the earnings of other remaining companies also increase. Because the interest rate is high, they charge more for lending to their customers.

Bonds or stocks: Which is a Better Investment?

Which is the best investment for bonds or stocks? It depends on two things. The first goal is to determine what your personal goals are. And what do you want to achieve? Enjoy receiving regular payments if you want to succeed in your goals. And if you are also not worried about inflation, bonds are an option for you. If stock market prices fall, even if you want to outgrow inflation, the stock market will give you more upside.

The second objective is how the country's economy is doing. If the economy is expanding rapidly, it is better for stocks; it will give you more profit than bonds. You can increase your income and your value by implementing this strategy. Bonds are also a better investment as they provide income and protect your investment

Conclusion

It is crucial to understand how bonds affect the stock market to make a better investment. Bonds have a significant impact on the stock market. Even though these two are inversely related, they depend on each other. Bonds provide a strong and safe platform for income. Therefore, investors must understand this relationship to benefit from the best investments. We hope this article answers your question on how bonds affect the stock market.

On this page

What is a Bond? What is a Stock? Relationship Between Bonds and Stocks How does inflation affect the relationship between bonds and the stock market? Factors that affect the relationship between bonds and stock market Interest rate Federal funds rate What happens when interest rates Rise? What is the best investment when interest rates are Rising? What happens when the interest rate falls? Bonds or stocks: Which is a Better Investment? Conclusion

By Rick Novak : Sep 05, 2024

Unveiling the Mystery: What Exactly Is a Manufactured Home?

Curious about manufactured homes? Learn what they are, how they differ from traditional housing, and why they're becoming a popular choice for many.

Read More

5651

By Rick Novak : Aug 02, 2024

How to Build the Best Lazy Portfolio: A Beginner's Guide

Learn how to create a lazy portfolio with our beginner-friendly guide. Find out about asset allocation, fund selection, and tips for long-term success.

Read More

9119

By Kelly Walker : Nov 22, 2024

International Bank Account Number (IBAN): A Comprehensive Guide

IBAN number is globally used to make banking and transferring money easier and more secure. You can check it easily with your bank or online checkers.

Read More

8339

By Kelly Walker : Oct 05, 2024

Potential Warnings About Index Funds

Investing in index funds can be a great way to grow your money, but there are also potential risks that should be considered. Learn what you need to know and pay attention to before making an informed decision about your finances.

Read More

14090

By Kelly Walker : Dec 04, 2024

Understanding the Expenses of Nursing Home Care

Get an estimate of the typical cost for nursing home care now and know about the expenses in senior living facilities.

Read More

16995

By Kelly Walker : Dec 17, 2024

Price vs. Stock Value: What's the Difference?

The price of the stock is what you actually pay for it. However, value is an intrinsic feature of an asset.

Read More

14317

By John Davis : Oct 25, 2024

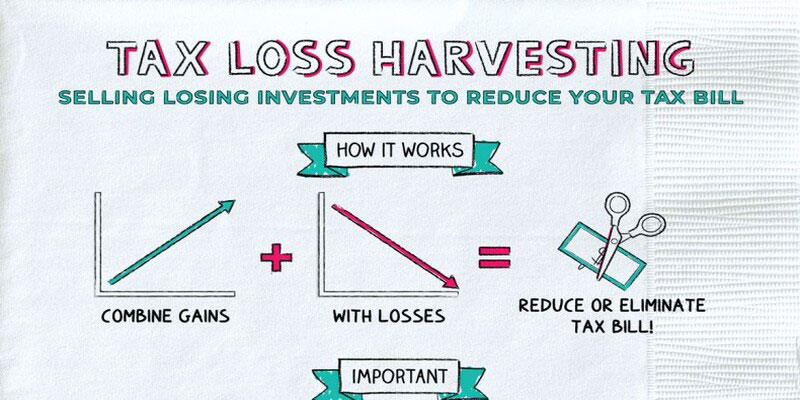

Why You May Profit From Tax-Loss Harvesting

When an investor realizes a loss on an investment, the loss can be used to offset the capital gains tax that was previously paid on a profitable investment. Incorporating this strategy into your investment approach could help you increase your portfolio's returns while decreasing your tax bill. Gaining the most from tax-loss harvesting requires investors to plan ahead regarding the timing and form of their sales, take into account the wash sales restrictions, as well as make use of tax-loss harvesting methods.

Read More

17017

By John Davis : May 18, 2025

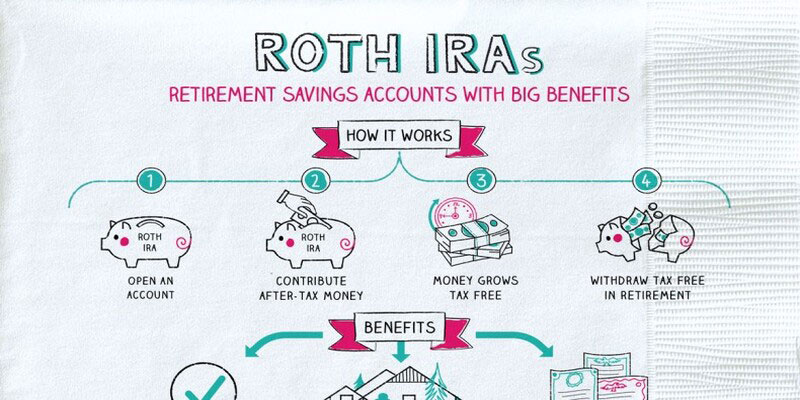

What Should You Know About Roth IRAs?

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances.

Read More

1935

By John Davis : May 18, 2025

How To Stay On Track With Your Financial Plan Resolves For The New Year

New Year's financial resolutions are more likely to be kept if they involve setting realistic and measurable goals, creating a budget, automating savings, reducing debt, boosting income, reviewing insurance, seeking professional guidance, and keeping motivation levels high. If you follow these steps, you'll be on your way to building the financially stable future you've always imagined.

Read More

7276

By Kelly Walker : Nov 19, 2024

Is a Personal Loan Right for You? Top Reasons to Consider

Explore why taking out a personal loan could be a smart move for your finances and future. Learn about the benefits and scenarios where a personal loan could be your best option.

Read More

3187

By Kelly Walker : Sep 11, 2024

An Easy Guide To Postdated Checks: What You Need To Know

Learn about postdated checks: what they are, how they work, legal issues, banking, and alternatives

Read More

981

By Rick Novak : Dec 19, 2024

Planning for Retirement: How Much Money is Enough

How Much Money You Need for Retirement: Tips for Calculating Your Savings Goal and Ensuring Financial Security in Your Golden Years

Read More

4515