Understanding the Expenses of Nursing Home Care

The importance of nursing home care for people who need constant medical attention and help with daily tasks is very critical in eldercare. Its important to be aware of the costs of nursing homes before you plan for long-term care of family members. In this article, we will discuss factors affecting these costs, average costs, and other details that will help families make informed decisions to make sure their loved ones receive top-notch support without breaking the bank.

1. Factors Influencing Costs

The cost of a nursing home can change because it depends on many things. The location, how much care is needed, what facilities are available, and if the place is run by a non-profit or for-profit organization all play into this. Also, the type of room - private or semi-private - and any special services needed will impact this cost too.

Additionally, the pricing of a nursing home can be impacted by its reputation and standards. Homes that have better ratings and more luxurious amenities might demand higher prices for their services.

- Consideration: Don't forget to inquire about any hidden fees or additional charges not included in the initial pricing quote.

- Caution: Be cautious of facilities offering significantly lower prices, as they may compromise on the quality of care provided.

2. Room Types and Costs

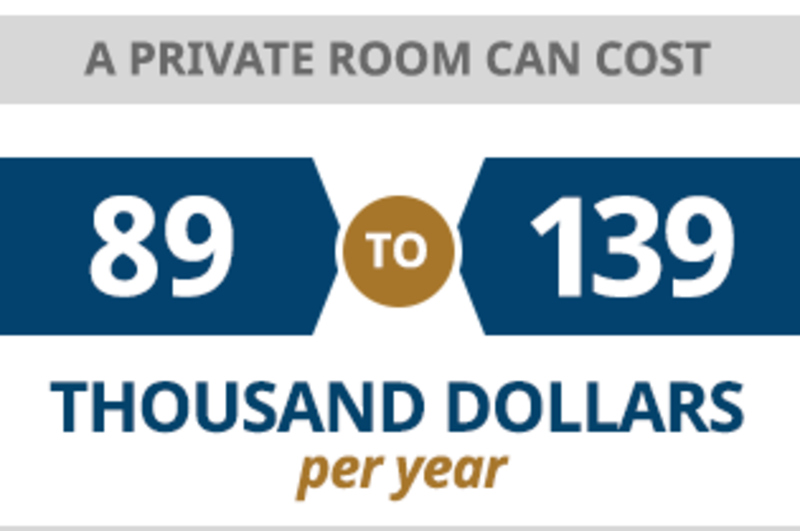

In nursing homes, there are usually two kinds of rooms available: private and semi-private. A private room means you have your own living space while a semi-private room is shared with one other resident. Private rooms tend to be more expensive because they provide more privacy and personal area to the inhabitants. The cost of a private room can vary significantly depending on factors such as location, amenities, and level of care provided. On average, private rooms in nursing homes can cost anywhere from $4,000 to $10,000 per month.

Conversely, semi-private rooms are less costly as they involve sharing accommodation with another resident. Sharing a room can offer social interaction and companionship, which some residents may find beneficial. Semi-private rooms are typically more affordable, ranging from $2,000 to $6,000 per month or even more, depending on various factors such as facility amenities and geographic location.

- Consideration: Factor in the preferences and comfort of the resident when choosing between private and semi-private rooms.

- Caution: Ensure that the chosen room type aligns with the resident's healthcare needs and personal preferences.

3. Basic Services and Additional Expenses

A regular price for a nursing home usually includes basic things like a place to stay, food, help with daily tasks, and healthcare services. But, sometimes extra costs are there for special services such as physical therapy, occupational therapy, or managing medications and supplying medical items. It is very important to ask if these added expenses are included in the whole price or billed separately.

Moreover, nursing homes often provide recreational activities, transportation services, and other facilities for the enjoyment of those living there. These extra services might have additional costs, thus it is necessary to understand what is comprised in the basic price and what falls under optional amenities.

- Consideration: Ask for a detailed breakdown of all included services and any optional amenities available.

- Caution: Be mindful of potential fluctuations in pricing for additional services, as they may impact the overall cost of care.

4. Financial Assistance Options

Financial aid for nursing home care can be helpful as it is often a big monetary responsibility. But, there are different options to help lessen the financial load. These include Medicare, Medicaid, long-term care insurance, benefits from veterans, and private pay choices. Every choice has its own set of qualifying conditions and coverage restrictions, thus it is critical to investigate all feasible paths to identify the most suitable answer for your situation.

Additionally, certain nursing homes may have special financial help programs or adjust their fees according to income for those who qualify. These initiatives might give extra assistance to families with monetary difficulties and guarantee that they can afford good care for their family members.

- Consideration: Research eligibility requirements and application processes for various financial assistance programs to determine the most suitable option.

- Caution: Keep in mind that eligibility criteria and coverage limitations may vary depending on the program, so it's essential to review the details carefully.

5. Long-Term Care Insurance

Long-term care insurance is specifically designed to cover the costs of nursing home care, assisted living facilities, and other long-term care services. Premiums for long-term care insurance vary based on factors such as age, health status, coverage amount, and optional benefits. While purchasing long-term care insurance can provide financial security in the event of needing nursing home care, it's essential to review the policy details carefully to understand the coverage and limitations.

With long-term care insurance, there could be certain waiting periods before benefits can be received, along with restrictions on how long or what sum of coverage is given. Knowing these terms and conditions of the policy is very important when deciding about financing for your future care needs.

- Consideration: Compare quotes from multiple insurance providers to find the most cost-effective coverage option.

- Caution: Be aware of any pre-existing conditions or exclusions that may affect coverage under a long-term care insurance policy.

6. Medicare Coverage

Medicare can help with the cost of short-term stays in nursing homes, but this is only for people who need skilled nursing care after being in a hospital. Medicare generally does not cover long-term stays at nursing homes for custodial care, which means help with daily activities. It's important to learn about what Medicare will pay for and find other ways to get financial help if you need a nursing home for a long time.

Also, specific rules apply to Medicare's coverage of nursing home care. The person needing care should first have a "qualifying" hospital stay. Additionally, their condition must require skilled nursing or rehabilitation services that can only be provided in a nursing home setting. Expenses for nursing home care are eligible under Medicare if residents meet these criteria.

- Consideration: Consult with healthcare providers and Medicare representatives to determine eligibility for coverage of nursing home care under Medicare.

- Caution: Be mindful of the limitations of Medicare coverage and explore alternative financing options for long-term care needs.

7. Medicaid Coverage

Medicaid is a state and federally-funded program that provides health coverage to eligible low-income individuals and families. Medicaid may cover the costs of nursing home care for individuals who meet the program's eligibility criteria, including income and asset limitations. Eligibility requirements vary by state, so it's important to consult with a Medicaid specialist or elder law attorney to determine eligibility and navigate the application process.

Medicaid coverage for nursing home care may require individuals to spend down their assets to meet eligibility requirements. Planning strategies such as asset protection and Medicaid-compliant financial planning can help individuals preserve assets while qualifying for Medicaid coverage.

- Consideration: Seek guidance from Medicaid specialists or elder law attorneys to develop a comprehensive plan for qualifying and applying for Medicaid coverage of nursing home care.

- Caution: Be aware of Medicaid's look-back period, which can affect eligibility for coverage of nursing home care expenses based on asset transfers made within a specified timeframe.

8. Veterans' Benefits

Benefits from the Department of Veterans Affairs (VA) might assist veterans and their spouses with the expenses related to nursing home care. This can consist of a pension called Aid and Attendance Pension, which aids veterans or surviving partners who need help from someone else for daily activities like getting dressed and eating food. The requirements for receiving benefits from the VA differ, so it is wise that veterans along with their family members speak to an authorized VA representative about this matter.

Also, it's possible to organize VA benefits for nursing home care together with other financial assistance like Medicare or Medicaid. Knowing the way VA benefits work in combination with different programs can assist in getting the most out of monetary help for long-term care requirements.

- Consideration: Contact local VA offices or veterans' service organizations to access resources and support for navigating VA benefits for nursing home care.

- Caution: Be aware of potential changes in eligibility criteria or benefit amounts for VA programs, as these may impact financial planning for long-term care needs.

9. Private Pay Options

For those who don't meet the requirements of government assistance plans or have long-term care insurance, private pay is a different possibility to cover nursing home expenses. Private pay means using personal money, savings, or retirement accounts to pay the cost of staying in a nursing home. Most nursing homes have flexible payment schemes that can be adjusted to individual financial circumstances such as monthly payments or one-time transaction methods.

Additionally, in certain nursing homes, there are price reductions or financial rewards for those residents who pay privately. For instance, they may provide lowered rates to people committing for longer periods and offer advantages like a discount if payment is made ahead of schedule. These choices can assist in balancing the expenses associated with nursing home care for those individuals who decide to pay privately.

- Consideration: Negotiate payment terms and explore available discounts or incentives to optimize private pay options for nursing home care.

- Caution: Be prepared for potential fluctuations in pricing or unexpected expenses when paying privately for nursing home care, and consider establishing a financial reserve for unforeseen costs.

Conclusion

The usual expense for a nursing home can differ, depending on where it is located, the care level provided, the type of room, and the services offered. Families must consider these costs and look into possible financial help when they plan for their loved ones' extended care in a nursing facility. By checking out what resources are there and getting advice from money advisors or eldercare experts, families can decide with knowledge to maintain good care for their elderly relatives without risking financial stability.

By John Davis : May 18, 2025

What Should You Know About Roth IRAs?

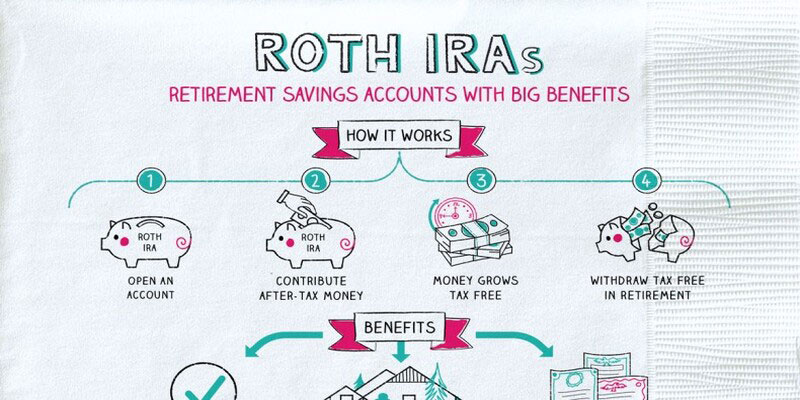

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances.

Read More

7900

By Rick Novak : Nov 02, 2024

How do you calculate interest on a loan?

To determine the interest payment, multiply the monthly rate of interest by the amount of outstanding loan balance.

Read More

1116

By Rick Novak : Nov 03, 2024

Unlocking the Path to Credit Repair

Understand the detailed process to eliminate a charge-off from your credit report and boost your credit score properly.

Read More

14322

By Rick Novak : Dec 05, 2024

Trading with Momentum: An Overview

On paper, momentum investing is less of a conscious strategy and more of a reactive response to market news. The traditional proverb on Wall Street that you should "buy cheap and sell high" runs opposite to the approach of selling underperforming companies and purchasing winning ones. This technique, which may appear enticing at first, is counterproductive

Read More

8313

By Kelly Walker : Dec 08, 2024

Using A Tax Break For Your Second Mortgage Payments

The federal government is aware that, for many people in the United States, securing a mortgage will be the most significant long-term financial commitment they will ever make. Because of a provision established by the Internal Revenue Agency, the interest you pay on your mortgage can be deducted from the taxes you owe

Read More

5162

By Kelly Walker : Sep 11, 2024

An Easy Guide To Postdated Checks: What You Need To Know

Learn about postdated checks: what they are, how they work, legal issues, banking, and alternatives

Read More

12396

By John Davis : May 18, 2025

What Are The Key Differences Between Exchange-Traded Funds (ETFs) And Index Funds?

Exchange-traded funds (ETFs) and index funds allow investors to purchase a diversified portfolio of securities. While index funds are mutual funds meant to passively track a specific market index, exchange-traded funds (ETFs) are traded like individual stocks. They can be managed either passively or aggressively. ETFs typically have lower entry thresholds than index funds, and ETFs change more frequently.

Read More

3079

By Kelly Walker : Nov 22, 2024

International Bank Account Number (IBAN): A Comprehensive Guide

IBAN number is globally used to make banking and transferring money easier and more secure. You can check it easily with your bank or online checkers.

Read More

5461

By Kelly Walker : Aug 13, 2024

What Is Faith-Based Investing?

Learn faith-based investing, the types of investments available, and how to ensure your portfolios align with your moral beliefs and religious convictions. Get a comprehensive guide to get started on ethical investing today!

Read More

16738

By Kelly Walker : Nov 17, 2024

Walking Away from a Home and Mortgage: A Comprehensive Guide

Thinking about walking away from your home and mortgage? Understand the implications, consequences, and alternatives with our comprehensive guide.

Read More

7701

By Rick Novak : Jan 06, 2025

5 Top VA Loan Lenders

Explore the best VA loan lenders to find out about top choices so you can make better decisions for financial assistance.

Read More

4884

By John Davis : May 18, 2025

How To Stay On Track With Your Financial Plan Resolves For The New Year

New Year's financial resolutions are more likely to be kept if they involve setting realistic and measurable goals, creating a budget, automating savings, reducing debt, boosting income, reviewing insurance, seeking professional guidance, and keeping motivation levels high. If you follow these steps, you'll be on your way to building the financially stable future you've always imagined.

Read More

11665