Walking Away from a Home and Mortgage: A Comprehensive Guide

Walking away from a home and mortgage is a decision fraught with financial and emotional implications. It's not just about packing your bags and leaving; it involves legalities, financial ramifications, and lasting effects on your credit and future housing options.

Whether due to financial hardship, strategic default, or other reasons, here's what you need to know before making such a significant decision.

Understanding the Decision to Walk Away

Deciding to walk away from your home and mortgage is a big step. It typically happens when homeowners find themselves unable or unwilling to continue making mortgage payments. This can be due to various reasons, such as job loss, unexpected financial burdens, declining property values, or simply being unable to afford the home any longer.

Walking away is often seen as a last resort after exhausting other options like loan modification, refinancing, or selling the property. It's crucial to evaluate all alternatives and understand the consequences before taking this drastic measure.

The Legal and Financial Consequences

When you walk away from your mortgage, you're essentially defaulting on your loan obligations. This triggers a series of legal and financial consequences:

Foreclosure Process

In many jurisdictions, lenders have the right to foreclose on your property if you stop making payments. Foreclosure is a legal process through which the lender repossesses the home and sells it to recover the outstanding debt.

Effect on Credit Score

A foreclosure can lower your credit score considerably. It could be tough to get new credit or loans in the future if it stays on your credit report for up to seven years. A 300-point decline in your credit score could have an impact on many facets of your financial life.

Deficiency Judgments

If the sale of your house isn't enough to pay off the remaining mortgage total, your lender may be able to get a deficiency judgment, depending on the regulations of your state. This means that even if you lose the property, you can still be liable for the outstanding loan.

Tax Implications

The IRS may consider forgiven debt (such as in a foreclosure or short sale) as taxable income. However, certain provisions like the Mortgage Forgiveness Debt Relief Act may provide exceptions under specific circumstances.

Considering Alternatives

Before walking away, consider these alternatives:

Loan Modification

This entails negotiating contractual changes, including lowering interest rates or lengthening the payback duration, with your lender.

Short Sale

With the lender's consent, a short sale occurs when you sell your house for less than the remaining mortgage sum. By doing this, you can lessen the damage to your credit and prevent foreclosure.

Deed in Lieu of Foreclosure

This option allows you to transfer ownership of the property to the lender voluntarily, avoiding foreclosure. It's less damaging to your credit than a foreclosure but still has consequences.

Renting Out the Property

If feasible, renting out your property can generate income to cover mortgage payments until you stabilize your financial situation.

Steps to Take If You Decide to Walk Away

If you've weighed your options and choose to walk away from your home and mortgage, it's essential to proceed with careful planning and consideration of the following steps:

Consult with a Real Estate Attorney

Consult with an experienced real estate lawyer with experience in property law and foreclosures before making any final decisions. They can offer vital information about the legal repercussions of quitting your mortgage.

A real estate lawyer can guarantee that your rights are upheld during the foreclosure process, provide guidance on possible legal defenses or ways to lessen the effects, and explain the foreclosure procedure as it relates to your state.

Notify Your Lender

Once you've made the decision to stop making mortgage payments, it's important to notify your lender promptly. This communication is crucial as it initiates the official process of foreclosure or explores alternatives such as a short sale or deed in lieu of foreclosure.

Be prepared to discuss your financial situation honestly with your lender and provide any necessary documentation they request. Understanding their perspective and negotiating in good faith can sometimes lead to more favorable outcomes, such as avoiding foreclosure altogether or minimizing the impact on your credit score.

Prepare for Transition

Walking away from your home means you'll need to arrange for new housing. Evaluate your current financial situation and explore options for renting a more affordable property or purchasing a home within your means. Start researching rental listings or potential new homes in advance to ensure a smooth transition.

If possible, save up for a security deposit and any additional expenses associated with moving to a new residence. Planning ahead can reduce stress and uncertainty during this period of transition.

Monitor Your Credit

Your credit score may be severely impacted by a foreclosure, which may make it difficult for you to get credit cards or advantageous interest rates in the future. It's critical to routinely check your credit report in order to be aware of any updates or errors.

To ensure accuracy, get a copy of your credit report from each of the three major credit agencies (TransUnion, Equifax, and Experian). Check for any inconsistencies in the status of your mortgage and foreclosure. In order to maintain the accuracy of your credit history, swiftly challenge any errors you find with the credit reporting organizations.

Conclusion

Walking away from a home and mortgage is a complex and consequential decision. It involves understanding legal, financial, and emotional aspects that can impact your life for years to come. While it may offer relief from immediate financial pressures, it's crucial to consider all alternatives and seek professional advice before taking this step.

Walking away is a serious choice that requires careful consideration of its long-term effects on your financial stability and personal well-being. By understanding the process and seeking guidance when needed, you can navigate this challenging situation with greater confidence and clarity.

On this page

Understanding the Decision to Walk Away The Legal and Financial Consequences Foreclosure Process Effect on Credit Score Deficiency Judgments Tax Implications Considering Alternatives Loan Modification Short Sale Deed in Lieu of Foreclosure Renting Out the Property Steps to Take If You Decide to Walk Away Consult with a Real Estate Attorney Notify Your Lender Prepare for Transition Monitor Your Credit Conclusion

By John Davis : May 18, 2025

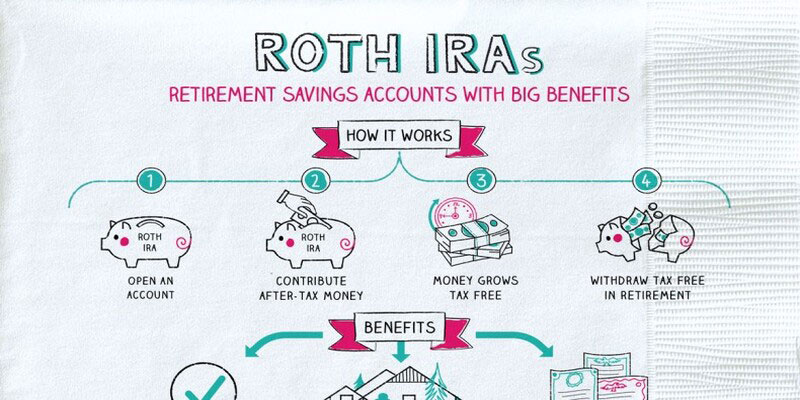

What Should You Know About Roth IRAs?

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances.

Read More

14842

By Kelly Walker : Nov 17, 2024

Walking Away from a Home and Mortgage: A Comprehensive Guide

Thinking about walking away from your home and mortgage? Understand the implications, consequences, and alternatives with our comprehensive guide.

Read More

6715

By Rick Novak : Aug 31, 2024

What Is an Income Fund?

Get the answers on income funds and learn how they can help diversify your investments. Explore all of the different types available with expert advice.

Read More

18117

By Rick Novak : Dec 27, 2024

The U.S. Treasury Yield Spread What You Need to Know

Discover what the U.S. Treasury yield spread is, how it impacts the economy and financial markets, and why it's important for investors.

Read More

13242

By Rick Novak : Oct 29, 2024

Crossing the Financial Bridge: A Comprehensive Bridge Loan Guide

Explore bridge loans: learn types, how they work, and examples. Discover how they bridge financial gaps effectively.

Read More

15236

By Kelly Walker : Oct 05, 2024

Potential Warnings About Index Funds

Investing in index funds can be a great way to grow your money, but there are also potential risks that should be considered. Learn what you need to know and pay attention to before making an informed decision about your finances.

Read More

19527

By Rick Novak : Aug 14, 2024

The Pros and Cons of Holding a Day Trading Position Overnight

Should you hold a day trading position overnight? Explore the risks and potential rewards of overnight trading in this informative article.

Read More

14596

By Kelly Walker : Dec 04, 2024

Understanding the Expenses of Nursing Home Care

Get an estimate of the typical cost for nursing home care now and know about the expenses in senior living facilities.

Read More

15338

By Rick Novak : Sep 05, 2024

Unveiling the Mystery: What Exactly Is a Manufactured Home?

Curious about manufactured homes? Learn what they are, how they differ from traditional housing, and why they're becoming a popular choice for many.

Read More

17009

By Kelly Walker : Aug 05, 2024

Reasons to Avoid Index Funds

Thinking of blindly investing in index funds? Here are some potential risks to consider before you make that decision. Find out the reasons why you should avoid index funds and explore alternatives that may be a better fit for your investment needs!

Read More

2764

By Rick Novak : Dec 05, 2024

Trading with Momentum: An Overview

On paper, momentum investing is less of a conscious strategy and more of a reactive response to market news. The traditional proverb on Wall Street that you should "buy cheap and sell high" runs opposite to the approach of selling underperforming companies and purchasing winning ones. This technique, which may appear enticing at first, is counterproductive

Read More

12571

By Rick Novak : Aug 01, 2024

Achieving Stock Market Mastery: Strategies for Winning Stocks

Discover how to choose winning stocks over losing ones. Practical tips for successful investing in the stock market.

Read More

6176