What Is an Income Fund?

Are you thinking about investing but don’t know where to start? One way to diversify your investments is by looking into income funds. This type of fund comprises a portfolio that collects dividend payments from stocks, bonds, and other securities.

Income funds provide investors with regular payments while potentially providing capital appreciation over the long term, depending on your chosen type.

In this blog post, we will discuss what an income fund is and explore the different types available so that you can make an educated decision when investing.

Overview of Income Funds and What They Invest In

An income fund is a type of mutual fund or exchange-traded fund (ETF) that invests in dividend-producing securities such as stocks, bonds, and other types of investments. These funds provide investors with regular payments while potentially providing capital appreciation over the long term.

Income funds generally have lower risk levels than their growth counterparts, so they are often used by investors seeking steady returns rather than high ones. They may also be attractive for those who want to benefit from tax advantages because many dividends are taxed at lower rates than earned income.

The Basics of Income Funds

Income funds invest in a portfolio of securities, such as stocks and bonds, that pay regular distributions or dividends to investors. These payments are often paid out quarterly but can also be set up to make payments more frequently.

The fund manager will decide which specific investments the fund should purchase and when they should be bought or sold to optimize returns. The main goal is for the fund to generate a steady income stream for its investors while attempting to maximize growth potential over time.

Types of Income Funds

Although there are a variety of income funds available, the following are some of the most commonly found:

1. Balanced Funds

These funds invest in stocks and bonds to provide investors with a mix of growth and income potential.

2. Bond Funds

Bond funds invest only in bonds, such as U.S. Treasury securities or corporate bonds, and are a great option for investors seeking steady income with limited risk.

3. REIT Funds

Real Estate Investment Trusts (REITs) pay out dividends to shareholders in exchange for ownership of real estate properties. REIT funds are designed to provide exposure to these types of investments without owning physical real estate.

4. International Funds

These funds invest in foreign stock markets and can provide investors access to higher-growth international opportunities while also providing diversification from domestic markets.

5. High Yield Funds

High-yield funds invest in securities that provide higher-than-average dividend yields. These funds can be risky, so they are best suited for investors seeking more aggressive returns.

6. Preferred Stock Funds

Preferred stocks have the potential to provide higher yields than common stocks, and preferred stock funds are designed to take advantage of these opportunities.

7. Utility Funds

Utility funds invest in companies that offer utility services such as electricity or water, which tend to pay reliable dividends and often have lower volatility than other sectors.

8. Equity Income Funds

Equity income funds focus on stable, large-cap companies with strong dividend histories and consistent earnings growth prospects.

9. Convertible Bond Funds

Convertible bond funds provide investors with both income potential and growth upside. These bonds can be converted into equity at a set price, giving the investor an opportunity for capital appreciation.

10. Floating Rate Funds

Floating rate funds invest in securities with variable interest rates, which are adjusted periodically in response to changing market conditions. This type of fund aims to provide investors with higher current income while potentially limiting risk due to lower volatility.

Benefits of Investing in Income Funds

1. Regular Income Stream

By investing in dividend-paying securities, income funds provide investors with a regular income stream.

2. Diversification

Investing in multiple types of securities within an income fund allows you to diversify your portfolio and reduce risk.

3. Tax Advantages

Many dividend payments are taxed at lower rates than earned income so investing in an income fund can help you enjoy tax savings.

4. Lower Volatility

Because most income funds invest in bonds and other non-equity investments, they tend to exhibit less volatility than equity markets. This makes them suitable for investors seeking steady returns over time rather than higher ones with greater risk potential.

5. Professional Management

Experienced professionals with the expertise to manage income funds to make sound investment decisions.

6. Access to High-Yield Securities

Investing in an income fund can access higher-yielding securities that may not be available through other avenues.

7. Liquidity

Investing in a mutual fund or ETF allows investors to enter and exit easily as their needs change.

8. Lower Minimum Investment Amounts

Income funds often require lower minimum investments than investing directly in individual stocks or bonds, making them accessible to smaller investors.

9. Lower Expenses

The expenses associated with managing an income fund are typically much lower than investing directly in individual stocks or bonds.

10. Potential for Capital Appreciation

Income funds can provide investors with long-term capital appreciation potential, depending on the type of income fund chosen.

Common Risks Associated with Investing in Income Funds

1. Interest Rate Risk

Changes in interest rates can cause the value of bonds and other fixed-income securities to decline, leading to losses in an income fund.

2. Market Risk

Income funds are subject to fluctuations in the stock market, so they may experience periods of high volatility or underperformance when markets are down.

3. a fund's performance largely depends on its manager's skill and expertise, so it’s important to research before investing.

4. Tax Risk

Some dividend payments may be taxed at higher rates than others, so it’s important to understand how this could affect your overall return.

5. Liquidity Risk

Some funds can be difficult to sell, especially during periods of low market activity or when the fund has few investors.

FAQs

How does the income fund work?

An income fund invests in a portfolio of stocks, bonds, and other securities to generate regular dividend payments to shareholders. The fund manager will actively manage the portfolio by selecting investments that have the potential to provide capital appreciation as well as current income in the form of dividends or interest payments. Additionally, these funds allow investors to diversify their portfolios since they are spread across multiple types of securities.

What is an Islamic income fund?

An Islamic income fund is an investment vehicle designed to comply with the principles of Sharia law. These funds will typically invest in securities that generate returns without engaging in activities prohibited by Islamic law, such as charging or receiving interest (riba), or investment. Some funds may incorporate certain social screening criteria, such as environmental sustainability and corporate governance, into their investment decisions.

What should I consider before investing in an income fund?

Before investing in an income fund, it is important to understand the different types of funds available and their associated risks. Additionally, investors should research the fund manager's track record and fees charged by the fund. Finally, assessing your financial goals and risk tolerance is important to determine which income fund type suits you best.

Conclusion

Income funds are a great way to diversify your investments while potentially generating regular income payments. Understanding the different types of funds available and their associated risks is important to make an educated decision when investing. With this knowledge, you can choose which income fund is right for you and your financial goals.

On this page

Overview of Income Funds and What They Invest In The Basics of Income Funds Types of Income Funds 1. Balanced Funds 2. Bond Funds 3. REIT Funds 4. International Funds 5. High Yield Funds 6. Preferred Stock Funds 7. Utility Funds 8. Equity Income Funds 9. Convertible Bond Funds 10. Floating Rate Funds Benefits of Investing in Income Funds 1. Regular Income Stream 2. Diversification 3. Tax Advantages 4. Lower Volatility 5. Professional Management 6. Access to High-Yield Securities 7. Liquidity 8. Lower Minimum Investment Amounts 9. Lower Expenses 10. Potential for Capital Appreciation Common Risks Associated with Investing in Income Funds 1. Interest Rate Risk 2. Market Risk 4. Tax Risk 5. Liquidity Risk FAQs How does the income fund work? What is an Islamic income fund? What should I consider before investing in an income fund? Conclusion

By Kelly Walker : Nov 17, 2024

Walking Away from a Home and Mortgage: A Comprehensive Guide

Thinking about walking away from your home and mortgage? Understand the implications, consequences, and alternatives with our comprehensive guide.

Read More

13067

By Kelly Walker : Dec 08, 2024

Using A Tax Break For Your Second Mortgage Payments

The federal government is aware that, for many people in the United States, securing a mortgage will be the most significant long-term financial commitment they will ever make. Because of a provision established by the Internal Revenue Agency, the interest you pay on your mortgage can be deducted from the taxes you owe

Read More

11582

By Kelly Walker : Nov 19, 2024

Is a Personal Loan Right for You? Top Reasons to Consider

Explore why taking out a personal loan could be a smart move for your finances and future. Learn about the benefits and scenarios where a personal loan could be your best option.

Read More

1517

By Rick Novak : Nov 02, 2024

How do you calculate interest on a loan?

To determine the interest payment, multiply the monthly rate of interest by the amount of outstanding loan balance.

Read More

7404

By Rick Novak : Dec 05, 2024

Trading with Momentum: An Overview

On paper, momentum investing is less of a conscious strategy and more of a reactive response to market news. The traditional proverb on Wall Street that you should "buy cheap and sell high" runs opposite to the approach of selling underperforming companies and purchasing winning ones. This technique, which may appear enticing at first, is counterproductive

Read More

19791

By Rick Novak : Aug 14, 2024

The Pros and Cons of Holding a Day Trading Position Overnight

Should you hold a day trading position overnight? Explore the risks and potential rewards of overnight trading in this informative article.

Read More

8592

By Kelly Walker : Dec 17, 2024

Price vs. Stock Value: What's the Difference?

The price of the stock is what you actually pay for it. However, value is an intrinsic feature of an asset.

Read More

18715

By Rick Novak : Sep 05, 2024

Unveiling the Mystery: What Exactly Is a Manufactured Home?

Curious about manufactured homes? Learn what they are, how they differ from traditional housing, and why they're becoming a popular choice for many.

Read More

10379

By Rick Novak : Dec 27, 2024

The U.S. Treasury Yield Spread What You Need to Know

Discover what the U.S. Treasury yield spread is, how it impacts the economy and financial markets, and why it's important for investors.

Read More

12422

By John Davis : Oct 25, 2024

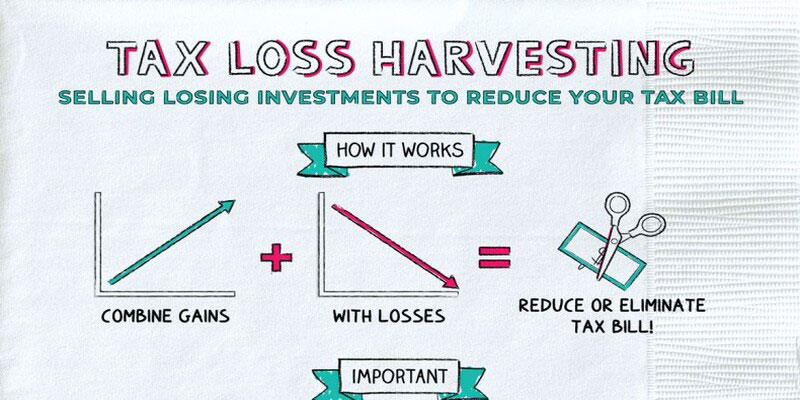

Why You May Profit From Tax-Loss Harvesting

When an investor realizes a loss on an investment, the loss can be used to offset the capital gains tax that was previously paid on a profitable investment. Incorporating this strategy into your investment approach could help you increase your portfolio's returns while decreasing your tax bill. Gaining the most from tax-loss harvesting requires investors to plan ahead regarding the timing and form of their sales, take into account the wash sales restrictions, as well as make use of tax-loss harvesting methods.

Read More

13559

By Rick Novak : Aug 01, 2024

Achieving Stock Market Mastery: Strategies for Winning Stocks

Discover how to choose winning stocks over losing ones. Practical tips for successful investing in the stock market.

Read More

2426

By Rick Novak : Dec 29, 2024

Things to Know Before Buying a Short Sale on a House

Check the property's value and the home for damage before buying shop board shorts on sale. Short sales may also require quick action.

Read More

10835