International Bank Account Number (IBAN): A Comprehensive Guide

Export of money to another country is not a novelty in the world, which is a global village than people can imagine today. This is where the IBAN international bank account number is commonly referred to as the IBAN. It is helpful to enable intercontinental transactions. However, what is an IBAN number, and what is its usage? This guide will tell you all you need to know about IBANs, including checking your IBAN account number and why they are the key to the global banking network.

What is an IBAN?

The IBAN international bank account number is the full form of the IBAN number. It is a uniform system of identifying bank accounts throughout the nations to make international transactions easier. It was first designed to facilitate faster and error-free international money transfer, which has been greatly facilitated by technology. The International Organization for Standardization and the European Committee for Banking Standards have played key roles in realizing this IBAN format.

Structure Of An IBAN

An IBAN number consists of up to 34 Alphameric characters comprising the elements below:

Country Code

A code composed of two digits to characterize the country; for instance, Global Britain refers to the code GB.

Check Digits

Two digits are used to verify the IBAN number.

Bank Identifier

A sequence of characters constituting the bank identifier

Account Number

The domestic bank account number

A UK IBAN is as follows: - GB29 NWBK 6016 1331 9268 19

In this example, GB refers to the country code for the United Kingdom. Twenty-nine are the check digits. NWBK is the bank identifier for the National Westminster Bank. The other digits stand for the individual bank account number.

Checking IBAN Account Number

Checking IBAN account number is easy, and all you have to do is follow these steps:

- Bank Statement: Your IBAN is mainly mentioned in your bank statement.

- Online Banking: All you do is register for your online banking service, and your IBAN will be displayed.

- Bank Branch: To obtain your IBAN for free, go to any branch nearby and ask for the details from the service provider.

- Customer Service in the Bank: Customers can contact customer care in the bank to get their IBAN details.

Benefits of IBAN

The IBAN Number plays an important role in the modern banking industry, especially in the process of carrying out international operations. It minimizes errors and delays in making electronic payments for cash by offering a uniform and unique means of categorizing bank accounts throughout the world.

For the same reasons that the IBAN international bank account number is composed of the country code, check digits, bank code, and account number, it contains validation checking capabilities to minimize the risk of fraud, thereby directing the funds to the right accounts. This endeavor helps improve the efficiency and security of global economic transactions, facilitating international business and the movement of monetary values.

Furthermore, the IBAN complies with the general banking practices of various countries, thus enhancing international banking security and saving costs roused by failed or spoiled attempts to transfer funds. Currently recognized in over 70 countries across the world, the use of IBAN in foreign payment transactions has been found to be very useful for banking, business, and individual organizations dealing with international financial transactions. Some other benefits of IBAN are:

- It reduces errors in cross-border payments since the IBAN ensures that the details of all accounts are correct and uniform and that there is smooth integration in business operations.

- It reduces the processing time of cross-border payments apart from ensuring the uniformity of its structure for processing.

- Low processing fees are charged on each cross-border transfer.

- Enhances security in cross-border transactions because an IBAN will always be in a transaction note.

How IBAN Supports Cross-border Transactions

In any international fund transfer, the recipient's IBAN will be required to credit the funds to the right account. A bank accepts an order only after validating a recipient's account using the IBAN. Checking IBAN Account Number ensures you do not transact with an account not meant to receive your funds.

The IBAN format is currently used in more than 70 countries, including twenty-eight countries in the European Union, Turkey, Saudi Arabia, Brazil, etc. Despite this, there is no so-called general format for using the IBAN. At the same time, the recommendations are based primarily on real experience in implementing the IBAN.

Common Misconceptions Associated with IBAN

Misconception 1: IBAN replaces the Bank Account Numbers

One thing that must be clear is that an IBAN international bank account number does not act as the bank account number but rather has the account number as part of an internationally accredited number format.

Misconception 2: Only European Countries Use IBAN

Even though the IBAN system was introduced in European nations, most of the countries in the global village have adopted it.

Misconception 3: IBANs are Difficult to Decipher

IBANs may seem complex on the surface. Nevertheless, they are designed to be user-friendly and reduce worldwide banking mistakes. Checking IBAN Account Number is pretty simple as well.

IBAN vs. BIC vs. SWIFT Code

SWIFT is the Society for Worldwide Interbank Financial Telecommunication. IBANs specify the account holder's country of residence and the account's unique amount, while SWIFT codes identify banks in cross-border transactions. It's like having a bank account and an American Bankers Association routing number on a worldwide scale.

In banking, a SWIFT code is more commonly referred to as a Bank Identifier Code (BIC), which is why SWIFT and BIC are sometimes used interchangeably. International wire transfers use the SWIFT network and BIC codes to be more technical.

Bank Identifier Codes (BICs) are more particular than IBAN international bank account numbers since they consist of three parts rather than two. An IBAN reveals a bank's country of business and an individual's exact account number inside that institution. It has a string of letters and numbers that make up a bank code of four letters, a country code of two letters, and a branch identifier of one letter and one number.

On this page

What is an IBAN? Structure Of An IBAN Country Code Check Digits Bank Identifier Account Number Checking IBAN Account Number Benefits of IBAN How IBAN Supports Cross-border Transactions Common Misconceptions Associated with IBAN Misconception 1: IBAN replaces the Bank Account Numbers Misconception 2: Only European Countries Use IBAN Misconception 3: IBANs are Difficult to Decipher IBAN vs. BIC vs. SWIFT Code

By John Davis : Oct 25, 2024

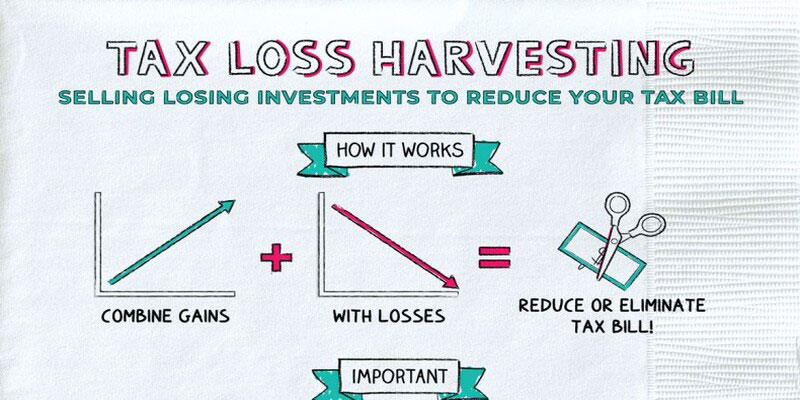

Why You May Profit From Tax-Loss Harvesting

When an investor realizes a loss on an investment, the loss can be used to offset the capital gains tax that was previously paid on a profitable investment. Incorporating this strategy into your investment approach could help you increase your portfolio's returns while decreasing your tax bill. Gaining the most from tax-loss harvesting requires investors to plan ahead regarding the timing and form of their sales, take into account the wash sales restrictions, as well as make use of tax-loss harvesting methods.

Read More

10486

By John Davis : May 18, 2025

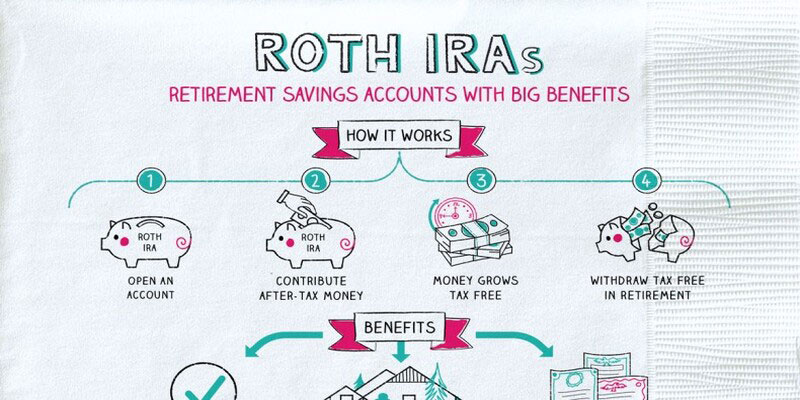

What Should You Know About Roth IRAs?

A Roth IRA is an individual retirement account that accepts contributions made with after-tax income. For those who anticipate being in a higher tax band in retirement, the special tax advantages a Roth IRA offers may make this investment vehicle a good choice. A Roth IRA is an individual retirement account to which nondeductible contributions may be made but from which tax-free distributions may be made under certain circumstances.

Read More

558

By Rick Novak : Dec 24, 2024

"Top Line vs. Bottom Line: Key Indicators of Financial Performance"

Explore key strategies for analyzing and enhancing your company's financial health through top and bottom line growth and strategic planning.

Read More

16362

By Rick Novak : Dec 27, 2024

The U.S. Treasury Yield Spread What You Need to Know

Discover what the U.S. Treasury yield spread is, how it impacts the economy and financial markets, and why it's important for investors.

Read More

126

By Rick Novak : Sep 05, 2024

Unveiling the Mystery: What Exactly Is a Manufactured Home?

Curious about manufactured homes? Learn what they are, how they differ from traditional housing, and why they're becoming a popular choice for many.

Read More

10375

By Rick Novak : Dec 19, 2024

Planning for Retirement: How Much Money is Enough

How Much Money You Need for Retirement: Tips for Calculating Your Savings Goal and Ensuring Financial Security in Your Golden Years

Read More

13940

By Rick Novak : Aug 31, 2024

What Is an Income Fund?

Get the answers on income funds and learn how they can help diversify your investments. Explore all of the different types available with expert advice.

Read More

1300

By Kelly Walker : Nov 19, 2024

Is a Personal Loan Right for You? Top Reasons to Consider

Explore why taking out a personal loan could be a smart move for your finances and future. Learn about the benefits and scenarios where a personal loan could be your best option.

Read More

9421

By Rick Novak : Dec 05, 2024

Trading with Momentum: An Overview

On paper, momentum investing is less of a conscious strategy and more of a reactive response to market news. The traditional proverb on Wall Street that you should "buy cheap and sell high" runs opposite to the approach of selling underperforming companies and purchasing winning ones. This technique, which may appear enticing at first, is counterproductive

Read More

15565

By Rick Novak : Dec 29, 2024

Things to Know Before Buying a Short Sale on a House

Check the property's value and the home for damage before buying shop board shorts on sale. Short sales may also require quick action.

Read More

12152

By Kelly Walker : Oct 22, 2024

Navigating Your Bank Account: Tips to Dodge Insufficient Funds Fees

Ever wondered how to dodge those pesky insufficient funds fees? Find practical strategies to keep your finances on track in this straightforward guide.

Read More

18489

By Rick Novak : Nov 02, 2024

How do you calculate interest on a loan?

To determine the interest payment, multiply the monthly rate of interest by the amount of outstanding loan balance.

Read More

3131