7 Proven Strategies for Maintaining A Good Credit Rating

A person's credit score is an influential indicator of their financial status. It gives lenders a quick indication of how responsible you are with credit. You are more likely to be approved for a new loan or line of credit if your credit score improves. A high credit score allows you to borrow money at lower interest rates. Boosting your credit score can be accomplished in several quick and simple ways. Improving your credit score may take a few months, but you can begin working toward it in a few hours. Here are a few important tips to understand regarding how to maintain a good credit score.

What Is the Importance of a Good Credit Score?

An individual's credit score is an indication of how well he or she manages debt. Lenders view you as more responsible if you have a high credit score. Using the FICO model, a credit score of 850 is considered perfect.

What is the benefit of having a high credit score? A better loan term and easier approval are the simplest answers. People with good or excellent credit scores can save hundreds of thousands of dollars throughout their lives. Mortgages, auto loans, and financing are more affordable for those with excellent credit.

Banks compete to attract creditworthy borrowers by offering better rates, fees, and perks to individuals with better credit ratings. A low credit rating, on the other hand, makes it harder for lenders to compete for the business. This results in businesses charging high annual percentage rates (APRs) to those with poor credit scores.

7 Tips to Build Good Credit Rating

It is, fortunately, possible to improve your credit score in several ways. It may take you weeks or months to complete some of these tasks. The following steps will assist you in improving your credit in a matter of days:

Stay on Top of Your Payment Schedule

It is essential that you make all of your payments on time. This is true for not only your credit cards but also your loans. If you fall behind on your rent or utility payments, your credit report could reflect this activity, even if you are not using a third-party service to report them. Keeping your credit score high requires paying all your bills on time.

Maintain a Low Credit Card Balance

Your credit score will be negatively affected if your credit card balance exceeds your credit limit. For a good credit score, balances on all your credit cards should be less than 30% of your credit limits.

Overcharging your credit limit by 30% is risky, even if you intend to make your payment on time. As soon as your statement closes, the card issuer will report your balance, which will appear on your credit report. It is a good idea to keep track of your accounts online and make payments in advance so that your balances are as close to zero as possible at the end of the billing period.

Keep Your Old Credit Cards Open

Closed credit cards are no longer updated by the three major credit bureaus- Experian, Equifax, and TransUnion- because your issuer never sends them the update- which can negatively affect your credit score since inactive accounts are given less weight in the scoring formula. When the credit bureaus remove the history of the closed account from your credit report after 10 years, your average credit age will be shortened, and your credit score will decline as well.

As a result of closing a credit card, you will have less available credit. If you close one credit card with a 3,000 credit limit out of three with a combined credit limit of $10,000, your limit will decrease to $7,000. As you want to maintain a credit card balance of less than 30% of your available credit, closing this credit card lowers your threshold by $900.

Don't Apply For New Credit Too Often

Having too many credit inquiries, particularly from credit card issuers, can also negatively affect your credit score. When you apply for multiple credit cards simultaneously, you may appear to be a risky borrower to lenders. In contrast, multiple inquiries made within a short period for a car loan or personal loan are counted as one inquiry because they typically reflect a consumer's search for the most competitive loan.

Don't apply for credit unless it is absolutely necessary. Your average credit age will also be lowered when you open a new credit card account.

Keep an Eye on Your Credit Report

It is important to note that just because you maintain good credit does not guarantee that everyone else will as well. Your credit score could be negatively affected if errors appear on your credit report.

A credit report can also be inaccurate as a result of identity theft and credit card fraud. Regularly reviewing your credit report throughout the year will enable you to detect these errors sooner, thus keeping your credit rating high.

Consolidate Your Debts

Taking out a debt consolidation loan from a bank or credit union could be advantageous if you have many outstanding debts to pay off. With just one payment to make, you'll be able to pay down your debt faster if your interest rate is lower on the loan. Your credit score can be improved by reducing your credit utilization ratio.

Don't Overextend Your Credit

It is difficult to resist the temptation to accept an invitation to a pricey new restaurant or not make a purchase while browsing through social media. However, if your spending gets out of control, you may find yourself using your credit cards excessively. At first, it may seem like you are receiving free money, but you will still have to pay it back. Overextending yourself may result in a late or missed payment if you fail to pay on time.

Instead, limit your spending to what you can manage and avoid overspending. By following these guidelines, you can ensure that credit cards are used responsibly.

Conclusion

You should strive to improve your credit score if you plan to make a major purchase in the future, for example, a new vehicle or home, or qualify for a rewards card. You are likely to see a noticeable improvement in your credit score within several weeks, if not months, once you begin taking steps to improve it.

On this page

What Is the Importance of a Good Credit Score? 7 Tips to Build Good Credit Rating Stay on Top of Your Payment Schedule Maintain a Low Credit Card Balance Keep Your Old Credit Cards Open Don't Apply For New Credit Too Often Keep an Eye on Your Credit Report Consolidate Your Debts Don't Overextend Your Credit Conclusion

By Rick Novak : Oct 29, 2024

Crossing the Financial Bridge: A Comprehensive Bridge Loan Guide

Explore bridge loans: learn types, how they work, and examples. Discover how they bridge financial gaps effectively.

Read More

3950

By Kelly Walker : Dec 04, 2024

Understanding the Expenses of Nursing Home Care

Get an estimate of the typical cost for nursing home care now and know about the expenses in senior living facilities.

Read More

4870

By Rick Novak : Nov 02, 2024

How do you calculate interest on a loan?

To determine the interest payment, multiply the monthly rate of interest by the amount of outstanding loan balance.

Read More

16083

By Rick Novak : Dec 19, 2024

Planning for Retirement: How Much Money is Enough

How Much Money You Need for Retirement: Tips for Calculating Your Savings Goal and Ensuring Financial Security in Your Golden Years

Read More

12700

By Kelly Walker : Nov 19, 2024

Is a Personal Loan Right for You? Top Reasons to Consider

Explore why taking out a personal loan could be a smart move for your finances and future. Learn about the benefits and scenarios where a personal loan could be your best option.

Read More

8917

By John Davis : Oct 25, 2024

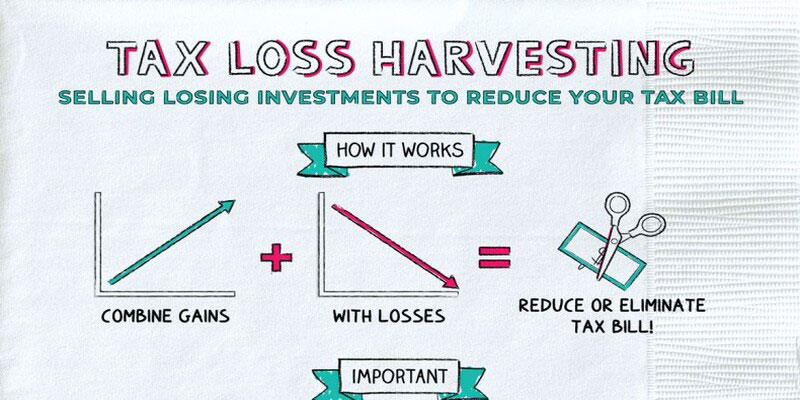

Why You May Profit From Tax-Loss Harvesting

When an investor realizes a loss on an investment, the loss can be used to offset the capital gains tax that was previously paid on a profitable investment. Incorporating this strategy into your investment approach could help you increase your portfolio's returns while decreasing your tax bill. Gaining the most from tax-loss harvesting requires investors to plan ahead regarding the timing and form of their sales, take into account the wash sales restrictions, as well as make use of tax-loss harvesting methods.

Read More

13208

By Kelly Walker : Nov 17, 2024

Walking Away from a Home and Mortgage: A Comprehensive Guide

Thinking about walking away from your home and mortgage? Understand the implications, consequences, and alternatives with our comprehensive guide.

Read More

16664

By Rick Novak : Jan 06, 2025

5 Top VA Loan Lenders

Explore the best VA loan lenders to find out about top choices so you can make better decisions for financial assistance.

Read More

2953

By Rick Novak : Aug 01, 2024

Achieving Stock Market Mastery: Strategies for Winning Stocks

Discover how to choose winning stocks over losing ones. Practical tips for successful investing in the stock market.

Read More

10483

By Kelly Walker : Dec 17, 2024

Price vs. Stock Value: What's the Difference?

The price of the stock is what you actually pay for it. However, value is an intrinsic feature of an asset.

Read More

2679

By Rick Novak : Sep 05, 2024

Unveiling the Mystery: What Exactly Is a Manufactured Home?

Curious about manufactured homes? Learn what they are, how they differ from traditional housing, and why they're becoming a popular choice for many.

Read More

19298

By Rick Novak : Aug 20, 2024

Debt and Credit Obsolescence and How to Survive It

Removing debt and credit score enhancement requires budgeting, spending only what you earn, and paying with cash or debit. Credit-checked services may also be limited

Read More

7387